Policy Management Software: Critical Tips for Selection

Even the best business strategy will take you nowhere if your technology cannot quickly scale to support it. In 2024, the insurance industry will not be confronted by new technology tools but the challenges they faced in 2023 will continue to intensify. An array of pressing risks—social, technological, environmental, economic, and political—have rapidly escalated over the past two decades. These challenges, once considered abstract or improbable, now demand immediate attention and are reshaping the very fabric of the business.

Unfortunately, established business and operating models have lagged behind this swift transformation. Insurers are under a tight deadline to respond, and the choices they make in the short term will significantly impact their long-term viability. In this evolving landscape, adaptation and innovation stand as critical imperatives.

Recognizing the pivotal role of technology, insurance leaders universally agree that investments in new technologies are crucial for market access, risk management, financial information, and customer service. Critical considerations include scalability, integration capabilities, user-friendliness, and alignment with regulatory changes. Top-tier policy management systems have intuitive interfaces, robust security, real-time analytics, and seamless integrations.

Embracing new technologies, such as AI, is imperative for insurers to stay competitive in the digital age. Collaboration with innovative insurance software vendors further enhances and future-proofs policy management systems.

Selecting a robust policy management software is a critical decision. Insurers do not need all the bells and whistles just because they are touted as the next game-changer, rather the focus should be on the best technology to achieve scale faster - in short, technology that aligns with your business strategy.

This guide unravels the intricacies involved in choosing and integrating new policy procedure management software by exploring key considerations, features, and industry trends.

Table of Contents

Topic: Modernizing Legacy Systems: when do insurers reach the tipping point?

- Part 1: The Triggers that Propel Insurers Toward Modernizing Legacy Systems

- Part 2: The Repercussions of Policy Management System Overload

Topic: How to choose an insurance platform modernization partner?

- Chapter 1: How to Make the Decision About a New Policy Platform and Insurtech Partner

- Chapter 2: 5 Ways to Conduct Insurtech Vendor Due Diligence

- Chapter 3: The 5 Tough Questions That Must be Asked of a Potential Insurtech Partnership

- Chapter 4: Software for Insurance Companies Build vs Buy

- Chapter 5: Why Not Every Insurance Platform Delivers on the ROI Promise It Made

- Chapter 6: Key Ways Traditional Insurers Can Gain the Most Benefit From Their Technology Partner

Topic: Steps to a Successful Core System Transformation for P&C Insurers

- Chapter 1: How Insurers Can Secure the Future by Building a Resilient and Intelligent Cloud Infrastructure

- Chapter 2: Why Insurance Carriers are Choosing to Migrate to Microservices

- Chapter 3: Why Implementations Often Cost Millions and Take 18 Months or More?

- Chapter 4: Big Fish Alternatives in P&C Insurance Core Systems

- Chapter 5: 10 Ways Insurers Win with SimpleINSPIRE's Core Insurance Platform

- Chapter 6: After Selecting a Phenomenal Insurance Admin System Why Does Project Implementation Fail?

Topic: Why AI and Automation will be a competitive differentiator in 2024

- Chapter 1: Software for Insurance COmpanies - Everything You Need to Know

- Chapter 2: AI in Insurance: Separating Hype From Substance

- Chapter 3: The Balancing Act between AI Ethics and Insurance Innovation

Modernizing Legacy Systems: when do insurers reach the tipping point?

As insurers navigate the complex intersection of tradition and innovation, the question arises: When do insurers reach the tipping point with their legacy systems, and how can the adoption of the best policy management software for their specific requirements play a transformative role in this journey?

The paradigm of software for insurance companies has shifted, and the imperative to modernize legacy systems is more pressing than ever. The critical juncture has arrived with most insurers finding themselves, scrutinizing the challenges, opportunities, and strategies involved in the pivotal process of modernizing legacy systems to embrace the digital future of insurance operations.

This journey is not just about shedding outdated technology; it's about embracing transformative change and leveraging the best policy management software that specifically matches the operational capabilities of each insurance company.

Part 1: The Triggers that Propel Insurers Toward Modernizing Legacy Systems

The decision to embark on the journey of modernizing and retiring outdated core systems is often deferred year after year. The perceived expenses, time commitment, and disruptions to daily business operations create an environment where it seems easier to postpone this crucial decision. In place of implementing comprehensive solutions, insurers often resort to patches and imperfect manual workarounds to address longstanding issues.

However, the challenges inherent in maintaining antiquated systems cannot be indefinitely overlooked. So, what prompts Chief Information Officers (CIOs) to reach the tipping point where modernization becomes necessary and imperative? Insurers must recognize that although their existing systems might maintain the operational status quo, they are not serving as a force multiplier to generate increased value for their business.

These are often the driving factors that lead to this transformative decision: The red flags that indicate that legacy insurance systems have outlived their usefulness

Part 2: The Repercussions of Insurance Policy Management System Overload

Today's consumers expect more – self-service options, quick quotes, and instant access to their policies. An insurance policy management software system that was considered top-of-line 10 years back will now have an existing configuration or operational capacity that will not effectively meet the dynamic demands and requirements of the insurance business.

Identifying the warning signs of an obsolete policy management system and taking swift action is imperative for sustaining operational excellence, adhering to regulatory standards, and enhancing customer satisfaction. This pushes insurers to contemplate upgrades, replacements, or architectural adjustments, ensuring their insurance systems stay robust and adaptable in the face of industry dynamism.

These are the key indicators that American insurers should consider when evaluating the health of their policy management software

How do you choose an insurance platform modernization partner?

Selecting the ideal insurtech partner is akin to house hunting. Much like when you're searching for your own home and have a list of essential "must-have" criteria, the indoor swimming pool, basketball court, and 10-car garage, though enticing, aren't mandatory requirements. At the same time, insurers do not want cookie-cutter solutions - they want a layer of customization that will answer their individual business needs.

Ernst and Young research found that insurers who partner with insurtechs benefit from new value propositions (75%), claims improvement (46%), and support distribution (43%).

Choosing the right insurtech company as a technology partner is a critical decision for insurers, as it can significantly impact their strategies, tactics, products, services, and overall results. A judicious selection can fuel innovation and efficiency, while the wrong choice may drain resources and waste valuable time. This process requires careful navigation through a complex landscape filled with nascent players, untested ideas, and evolving industry jargon, making it challenging to conduct precise comparisons.

Fortunately, clear best practices are emerging for the evaluation and selection of insurtech companies:

Chapter 1: How to Make the Decision About a New Policy Platform and Insurtech Partner

Chapter 2: 5 Ways to Conduct Insurtech Vendor Due Diligence

Chapter 3: The 5 Tough Questions That Must be Asked of a Potential Insurtech Partnership

Chapter 4: Build Custom Insurance Software vs Buy: The Pros and Cons

Chapter 5: Why Not Every Insurance Platform Delivers on the ROI Promise It Made

Chapter 6: Key Ways Traditional Insurers Can Gain the Most Benefit From Their Technology Partner

Steps to a Successful Core System Transformation for P&C Insurers

For many CIOs and CTOs replacing an insurance policy management system often feels like open-heart surgery. This sentiment is not an exaggeration given the challenges associated with major transformation efforts, complete with their ups and downs, delays, and hiccups—historically fraught with risks and taking years to complete.

The encouraging news is that deploying and integrating new technology, part of the digital transformation in the insurance industry, has evolved. It's no longer the grueling, multi-year endeavor of the past. Insurers now have viable options to retire legacy systems in favor of modern, efficient, cloud-native insurance policy management systems—all within a compressed timeframe, using incremental deployments and Agile methodologies to mitigate business disruption.

It's essential to recognize that adopting new technology requires a measured approach to the transformation process. While one of the primary drivers for insurance innovation is enhancing the customer experience, a modern core insurance system goes beyond this. It possesses the capacity to not only improve customer interactions but also to accelerate innovation, expand distribution through insurance ecosystem partnerships, and create more advantageous cost structures.

Insurance cloud computing adoption is not an end in itself but is essential for the broader digital transformation in the insurance industry.

In a recent 2023 study, 43% of insurers identified cloud and digital infrastructure as their top priority, outranking even big data initiatives.

Chapter 1: How Insurers Can Secure the Future by Building a Resilient and Intelligent Cloud Infrastructure

Chapter 2: Why Insurance Carriers are Choosing to Migrate to Microservices

Chapter 3: Why Implementations Often Cost Millions and Take 18 Months or More?

Insurtechs thrive on innovation, maintaining a pulse on cutting-edge technology and attracting top talent to ensure their success. However, the distinct differences in business processes, capabilities, and priorities between large and small carriers pose a challenge. It underscores the essential need for insurtech solutions to be tailored to the specific requirements of both large and small insurers.

Chapter 4: Big Fish Alternatives in P&C Insurance Core Systems

Chapter 5: 10 Ways Insurers Win with SimpleINSPIRE's Core Insurance Platform

In the insurance industry, a study by Ovum found that only 27% of insurers believed their policy administration system implementations were successful. What can go wrong?

Chapter 6: After Selecting a Phenomenal Insurance Admin System Why Does Project Implementation Fail?

Why AI and Automation will be a competitive differentiator in 2024

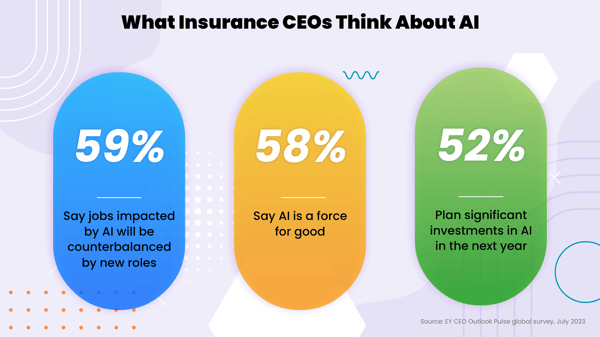

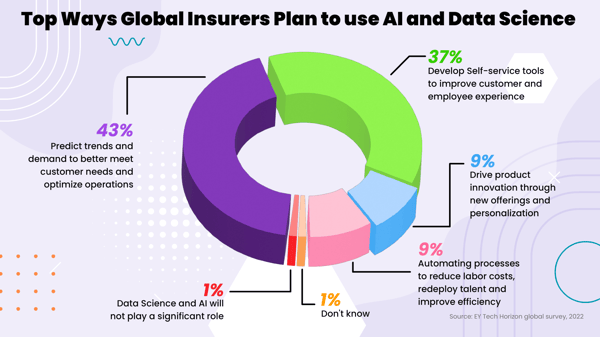

Modern business solutions are harnessing cutting-edge technologies like AI and machine learning to drive innovation. This dynamic duo, coupled with automation, serves as potent business intelligence tools, optimizing workflows and automating routine tasks such as data entry and email management through new systems.

Taking this technological leap beyond routine processes, we find AI applications in more complex tasks, like customizable and automated claims processing, dynamic AI underwriting, and AI-driven fraud detection. This not only liberates teams from manual work but also allows a focused redirection toward critical business areas.

Looking ahead to 2024, Cathy Seifert, Vice President at CFRA Research (financial intelligence insights), says that insurers will be forced to grapple with the influence of AI in the insurance industry. Recognized as both a threat and an opportunity, AI has the potential to significantly enhance profitability by refining underwriting and claims processes and reducing costs. However, it also acts as a bifurcating force among insurers, with not every entity ready or able to fully integrate AI in insurance into their workflows.

For insurers thriving on data, success lies in adeptly harnessing this wealth of information. Those excelling in this capacity are better equipped to assess risk and strategically optimize their approaches. Looking forward to 2024, the integration of AI and machine learning in insurtech applications is expected to advance, offering more sophisticated and personalized insurance solutions. The use of AI, chatbots, and interactive tools by insurtechs will further enhance the customer experience, making insurance more accessible and understandable.

Chapter 1: Ultimate Guide to AI for Insurance - Everything You Need to Know

Chapter 2: AI in Insurance: Separating Hype From Substance

Chapter 3: The Balancing Act between AI Ethics and Insurance Innovation

Topics: Legacy System Modernization