AI in Insurance: How Can Insurers Separate Hype From Substance?

Artificial Intelligence (AI) has taken the insurance industry by storm, promising groundbreaking transformations. Emerging AI technologies in insurance like Generative AI (Large Language Models), IoT, and Deep Learning have been accompanied by a wave of high expectations. Claims of AI's potential to automate every facet of the insurance process, from underwriting to claims settlement, have been widely circulated.

The AI hype is created because of the significant promise and potentially transformative impact that artificial intelligence holds in various industries, including insurance. Many insurers are concerned that if they do not rapidly adopt AI technologies, they will lag behind competitors and miss out on the potential benefits, such as cost savings, improved customer experiences, and enhanced risk assessment. This perception can lead to rushed, sometimes ill-considered adoption of AI, driven more by the fear of falling behind than a careful assessment of the technology's practical benefits.

New technologies do add value, the point is which of these technologies will suit your business. There is no one-size-fits-all when it comes to AI in insurance and separating the value from the hoopla becomes a necessity.

Past Technologies in Insurance: What Worked and Which Didn't

New technologies have emerged through the years, some fall by the wayside while others have transformed the way we live and work.

Personal Digital Assistants (PDAs) like Palm Pilots in the 1990s were expected to transform how professionals worked. They were seen as a means to digitize tasks, including claims processing, policy management, and data collection in the field.

In reality, while PDAs had some success, their adoption in insurance was limited. The technology and software for insurance-specific applications were not as robust as anticipated. Eventually, PDAs were replaced by smartphones, which offered more versatility and functionality.

The transition to digitalization and data processing, which began in the mid-20th century, brought efficiency to insurance operations. It continues to play a vital role in insurance. These technologies have not been replaced but are foundational to modern insurance operations. They have evolved and integrated with more recent technologies like AI.

The emergence of online quoting and direct sales in the early 2000s marked a significant transformation in insurance distribution. However, this did not replace the need for insurance agents and brokers. Instead, it offered customers a new way to access insurance products. This evolution demonstrates the insurance industry's adaptability to new technologies while retaining essential roles.

Also Read: New Policy Management Software: The Guide to Getting IT Right

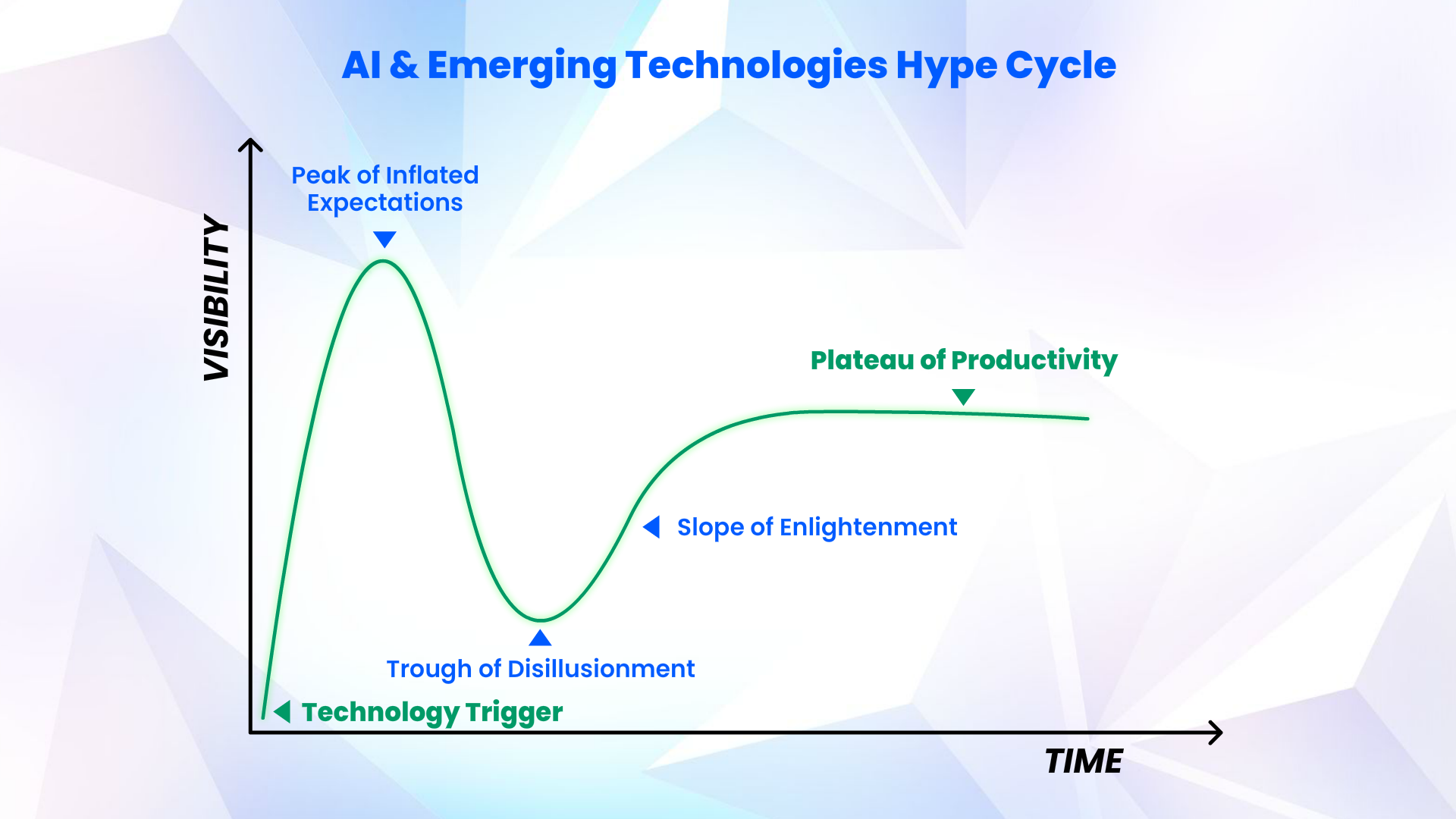

The Gartner Hype Cycle for Emerging Technologies

When we apply the Gartner Hype Cycle for emerging technologies in insurance, it is evident that the initial hype often overshadows the practical substance of these technologies. However, as insurers navigate through the phases of the AI Hype Cycle, they are better equipped to separate the hype from the substance.

Gartner has developed more than 90 hype cycles each year, tracking the evolution of emerging technologies as they gain momentum and evolve over time.

Every new AI technology arrives with a Technology Trigger phase and some create a buzz, quickly soaring to the Peak of Inflated Expectations. At this phase, the potential seems immense and vendors start looking at integrating it into their applications. Generative AI is currently in this phase according to Gartner. The Trough of Disillusionment forces a more realistic assessment because insurers can find themselves in situations where after a complex integration period, the potential is not realized. If insurers skip the trough of disappointment, it means it is a positive journey forward to the Slope of Enlightenment which enables insurers to make informed decisions about how AI can be effectively integrated into their operations.

Ultimately, the Plateau of Productivity represents the point where insurers have successfully separated the hype from the substance and are realizing tangible benefits from AI technologies. In broader terms that's when a technology's mainstream adoption takes off. It's the phase where we start to get a clearer picture of what makes a technology vendor reliable, and the technology's relevance in the broad market becomes obvious and beneficial.

The plateau of productivity is where all insurers want to reach in their AI integrations. It all boils down to simplicity. The insights from the AI hype cycle make it imperative to ask the question at the start “Will this technology simplify things for either my policyholders or my employees?” If you can be sure that it improves processes core to your business then it is real, else it is just hype with no long-term value.

A disclaimer that needs to be made here is that the objective might be simple, but rarely does simplicity apply to the technology that runs behind the scenes, which often is very complex.

Separating AI Hype from Substance for Both Larger and Smaller Insurers

To distinguish AI hype from substance while considering Gartner's Hype Cycle, it's crucial to recognize that not all insurers, whether large or small, require extensive AI applications. The key is to align AI solutions with the insurer's specific needs and objectives.

Strategic Alignment

For insurers, the key is to ensure that AI investments align with their specific business objectives, whether it's cost reduction, improved customer service, or better risk management. Avoid the temptation to adopt AI simply because of the buzz around it.

For instance, an insurance organization might have its goal as cost reduction. They can harness a blend of AI technologies like NLP, machine learning, predictive analytics, RPA, and rule-based systems to automate underwriting tasks. This automation streamlines underwriting, accelerates policy evaluations, and trims operational costs while ensuring data accuracy and uniformity.

Scalability and Resource Evaluation

Larger insurers can assess whether the technology can meet their extensive needs, while smaller insurers must evaluate whether it's feasible to implement with their existing resources.

Ethical and Regulatory Considerations

Insurance as an industry has to prioritize ethical and regulatory considerations. Ensure that AI in insurance adheres to legal and ethical standards, preventing potential issues arising from non-compliance.

Also read: Gen AI's Big Wins in Insurance But What About The Risks?

Pilot Projects

Start with pilot projects to test AI applications' viability and effectiveness. This is a prudent approach for both larger and regional insurers to minimize risks and assess practical benefits. For instance, a large insurer considering AI for personalized pricing starts with a pilot project targeting a specific customer segment. They evaluate the technology's effectiveness in providing tailored quotes while mitigating risks associated with nationwide adoption.

Insurance software can take months to a year or more to be customized and integrated with existing systems. This means that insurers exist in an uncertain state unsure if their new software will get them business value. At SimpleSolve we have an innovation wing that tests the practical applications of new technologies before they get integrated into the SimpleINSPIRE Platform. A rich network of ecosystem partners provides our insurance clients with options to integrate what works for them. Talk to us if you would like further insights about AI solutions that work best for your organization.

Topics: A.I. in Insurance

.jpg)