Reimagining and Redefining the Insurance Customer Experience

Insurance is constantly hearing the refrain that insurers need to reimagine the customer journey to optimize the experience for today’s new demographic of customers. What it overlooks though is that the new-age customer is not comparing one insurer against the other, rather their expectations are influenced by their experience with other industries.

Providing mobile apps, even enabling digital claims appraisals is not enough to guarantee customer satisfaction. In fact, it is what is expected. Reimagining the insurance customer experience requires an enterprise-wide paradigm shift because it involves changing the way that the entire organization approaches customer interactions. It is not just about making changes to the customer-facing parts of the business, such as sales or customer service; it requires a fundamental shift in the way the entire organization operates. It includes a shift from the traditional approach to one that relies on digital engagement, automation, and reliance on AI and data to personalize customer journeys.

How other industries have fueled insurance customer expectations

Customer expectations are constantly evolving, and experiences with other industries have played a significant role in shaping these expectations, including in the insurance industry. Customers now expect seamless and personalized experiences, regardless of the industry they are interacting with. The bar has been raised for customer expectations in the insurance industry, requiring insurers to adapt and innovate to meet these evolving demands.

For example, customers who are accustomed to shopping online for products and services expect a similar experience when interacting with their insurance providers. They want the ability to research, compare, and purchase policies online, without the need for extensive phone calls or in-person meetings.

Similarly, customers who are used to the fast and easy digital experiences offered by companies such as Amazon or Uber expect insurance providers to provide a similar level of convenience and speed. This means insurers need to provide quick, efficient service, with minimal paperwork and hassle.

Other industries, such as banking and retail, have also influenced customer expectations. Customers now expect to be able to access their policies and manage their accounts through online portals and mobile apps, just as they can with their bank accounts or online shopping accounts.

Additionally, the rise of social media has given customers a powerful tool for sharing their experiences with others. This means that insurance providers need to provide exceptional customer service and be responsive to customer feedback, as negative experiences can quickly spread through social networks and harm their reputation.

The Insurance sector is shifting from customer-focused to customer-centric

New business models are challenging the way insurers relate with their policyholders. A customer-focused organization listens to what the customer wants and provides them with exactly that. However, insurers are now expanding that boundary by understanding both the customer needs and behaviors and serving them seamlessly through the customer lifecycle. Any guesses on which approach increases customer retention?

Here is how both approaches work.

Customer-focused approach:

An insurance company with a customer-focused approach might offer a range of insurance products such as life insurance, health insurance, car insurance, and home insurance, to meet different customer needs. They may also provide easy access to information and support for customers, such as a user-friendly website, a mobile app, or a customer service hotline.

For example, let's say that a customer is looking for car insurance. With a customer-focused approach, the insurance company would offer a range of car insurance policies with different levels of coverage and price points. The customer would be able to compare and select the policy that best meets their needs and budget. The company may also offer online quotes and provide a streamlined application process to make it easy for the customer to purchase the insurance policy.

Customer-centric approach

In contrast, an insurance company with a customer-centric approach would go beyond just offering a range of products and providing information and support. They would focus on understanding each customer's unique needs, preferences, and behaviors, and create personalized solutions to meet them.

For example, let's say that a customer has a history of accidents and is concerned about the cost of car insurance. With a customer-centric approach, the insurance company may use data analytics to understand the customer's driving patterns and provide a personalized insurance policy that reflects their specific risk profile. The policy may include a telematics device to monitor the customer's driving behavior and adjust the premium based on their actual risk.

Another example of a customer-centric approach might be offering a bundled insurance package that includes home, auto, and life insurance coverage, tailored to the customer's specific needs and budget. The insurance company would leverage customer data and predictive analytics to anticipate the customer's future needs and provide personalized recommendations to help them make informed decisions.

In summary, while a customer-focused approach is important for meeting customer needs, a customer-centric approach takes it a step further by anticipating and personalizing solutions to meet individual customer needs and preferences.

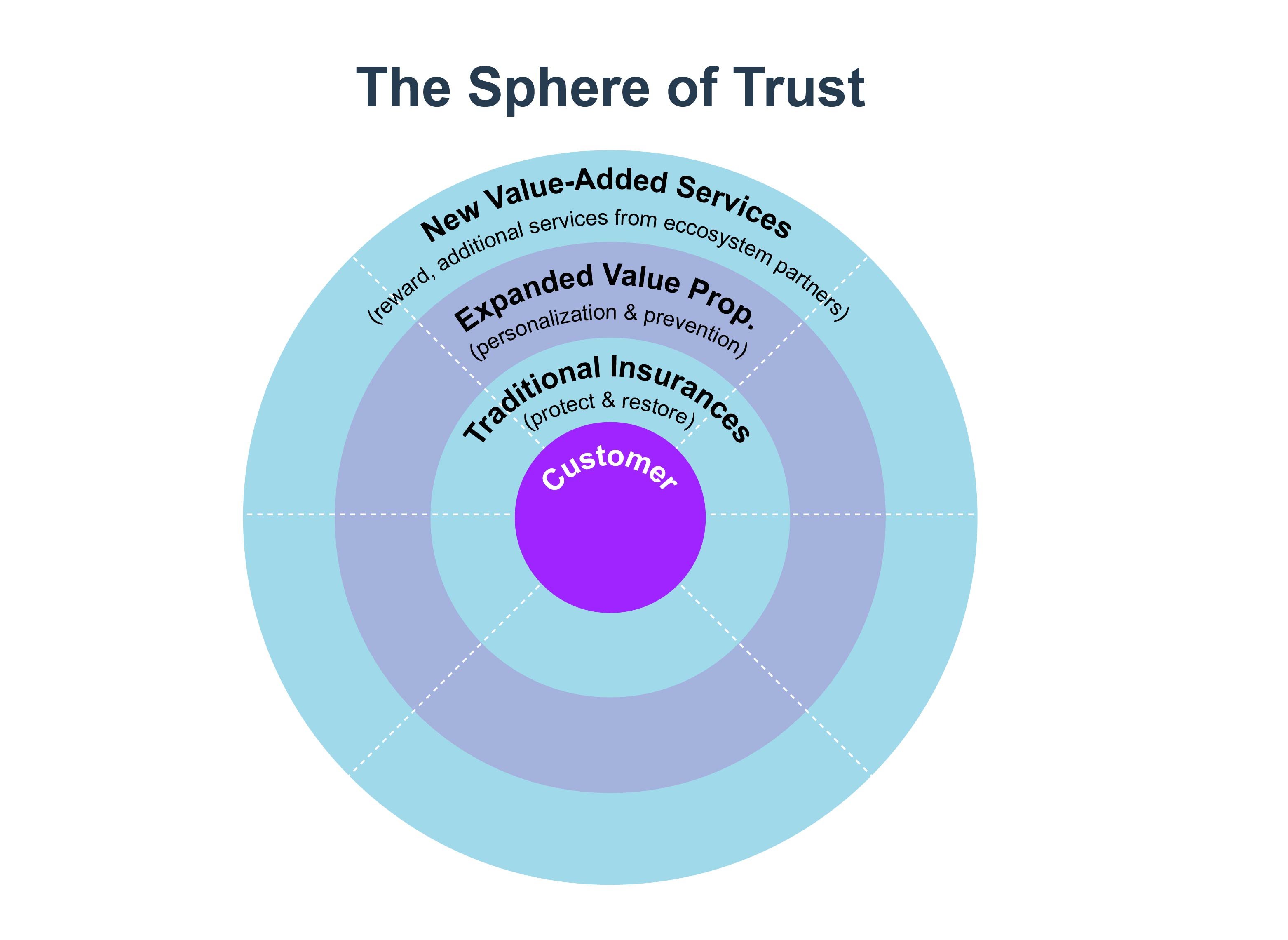

Redefining insurance customer experiences is all about creating a ‘sphere of trust’

In the context of the insurance industry and the reimagined customer experience, "Sphere of Trust" is a concept coined by Accenture to describe a framework for building and maintaining trust with customers. This is built on two fundamental changes - provide customized offerings and build partnerships. A redefined insurance customer experience cannot be handled by an insurer alone, it can only be delivered by building an ecosystem of different industries.

The Sphere of Trust is composed of three interrelated elements

The Sphere of Trust is composed of three interrelated elements

Relationship Trust: This element refers to the trust that customers have in their insurance provider and the quality of the products and services that they offer. This can be built through transparent and clear communication, personalized advice, and high-quality customer service.

Digital Trust: This element refers to the trust that customers have in the digital tools and technologies used by their insurance provider. Customers want to know that their personal information is secure and that digital interactions with their insurance provider are safe and reliable. This can be built through:

- Robust cybersecurity measures such as firewalls, intrusion detection and prevention systems, and encryption technologies. For instance, Multifactor authentication is built into SimpleINSPIRE core insurance platform to ensure that only authorized persons can access customer information and data. This requires users to provide a password and a second factor, such as a fingerprint or a security token.

- Insurance providers need to be transparent about how they collect, store, and use customer data. This includes providing clear data privacy policies that outline what data is collected, how it is used, and how it is protected.

Ecosystem Trust: This element refers to the trust that customers have in the broader ecosystem of partners and third-party providers that work with their insurance provider. Customers want to know that their insurance provider is working with trusted partners and that they can access a wide range of complementary products and services. This can be built through strong partnerships, clear and transparent relationships, and a focus on meeting customer needs.

Also read: The Problems Insurers Face If They Ignore Digital Ecosystems

Leveraging new technology from Insurtechs

In recent years, the insurance industry has undergone significant changes in how it approaches customer experience. With the rise of technology and changing customer expectations, insurers have had to adapt to meet the needs of their customers in new and innovative ways.

One of the biggest changes has been the shift towards digital channels for customer interaction. This includes everything from online quotes and policy management to mobile apps and social media (social media scoring is now also being used to set insurance premiums). Customers now expect to be able to interact with their insurers through multiple channels, at any time and from anywhere. This 24/7 connectivity is possible with the advent of virtual assistants and AI chatbots.

Insurers are also investing more in data analytics and AI to personalize customer experiences and offer more tailored products and services. This includes using predictive analytics to offer customized policy recommendations based on a customer's unique needs and preferences. Augmented reality (AR) and virtual reality (VR) technologies are also being used to conduct virtual inspections of a customer's home and identify potential risks. This would allow insurers to make more informed underwriting decisions and offer personalized coverage options to customers.

Another trend in customer experience is the increasing focus on transparency and simplicity. Insurers are striving to make policies and procedures easier to understand and more accessible, with plain language and intuitive interfaces.

To remain competitive, insurers will have to reimagine how they serve their customers. The earlier the better since creating sustainable models drives growth. What differentiates one insurance provider from another will be how quickly they adapt to customers’ changing needs and reinvent their offerings.

Topics: Digital Ecosystems

.jpg)

.jpg)