How Insurance AI Chatbots Are Improving Customer Experience

In 2016, AI Jim (Lemonade’s AI chatbot) set a world record for the fastest processing of an insurance claim - just under 3 seconds and with zero paperwork. By 2022, the global insurance chatbot industry generated an astounding $467.4 million. Conversational AI in Insurance is an important part of the growing demand for automation. In 2023, a Salesforce survey showed that 23% of customer service companies were already using conversational AI. However, the big boom in generative AI this last year has created greater interest in the transforming powers of large language models (LLM). Will this increased awareness lead to a greater adoption of insurance AI chatbots?

It is predicted that insurance AI chatbots will take over 95% of customer conversations, including telephone and online conversations. The insurance chatbots will be so advanced that customers will be unable to ‘spot the bot’.

Insurance AI Chatbot market trends and forecasts

For most people, the nitty gritty of insurance products is quite difficult to understand. Customers often say that quotes, premiums, and riders are such a complex subject that even after the purchase they are not too sure of all they are covered for. Customer service chatbots that can guide them through the purchase journey and provide them with clear information will make them more loyal to their insurance providers.

The insurance sector is one of the largest employers and many tasks require humans to constantly problem-solve on the fly. Insurance AI assistants will be invaluable in getting the right information to insurance professionals when they need it. Even more important will be the ability to have this information automatically added to the knowledge pool for both customers and co-workers. Large language models such as those that power ChatGPT are being tested by insurance giants like Zurich in areas such as claims and modeling (Financial Times)

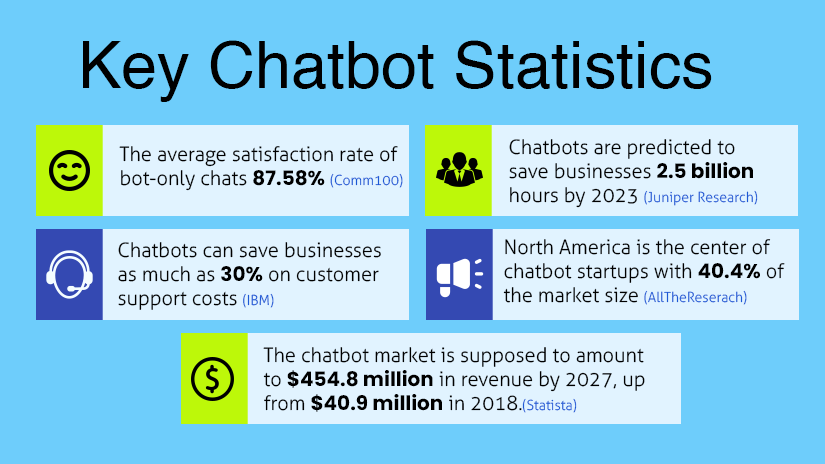

Here are a few market trends in the AI chatbot market:

Also Read: AI for Insurance - Everything You Need to Know

Use cases for Conversational AI in insurance

What is an unbeatable marketing technique? Almost every marketing guru will agree that it is treating customers with the respect they need and that’s the reason customer-centric strategies are now taking center stage. Policyholders' and consumers’ expectations have undergone a dramatic change as the world has gone even more digital. Given the rising expectation for round-the-clock service and receiving information almost instantly, insurers are revamping their processes to improve their interactions with policyholders.

Digital marketing has made it possible to reach consumers through a variety of channels. What happens though if a potential customer’s query on any of these channels goes unanswered? The probability is that they will go searching elsewhere to get the information they need. This is why, as part of an overall digital transformation, insurance carriers are leveraging chatbots in their multichannel interfaces. When conversation AI is properly implemented it can provide an ideal environment for a comprehensive guided buyer experience. This can reduce customer friction and generate 5 times as many leads for an insurance provider. It does not stop there, automation is also providing faster claims administration. That’s a happy customer.

The most successful insurance chatbots will be the ones that will drive a conversation perfectly mimicking a human agent.

Here are 3 effective use cases for AI conversational chatbots that insurance providers are in the process of evaluating and implementing.

Automating repetitive queries

80% of inbound customer queries are routine and insurance chatbots can easily resolve these queries while redirecting the remaining 20% to human agents. It is not just customers, the diversity and complexity of insurance products can make it difficult to understand even for stakeholders who might need clarifications.

Most insurance carriers have large contact centers with hundreds of customer support employees. However, the massive amount of queries coming in is difficult to handle for even such a large call center. Tie this in with the fact that the average response time is directly related to customer satisfaction. This is why customer chatbots in the insurance industry had the highest market share in 2022.

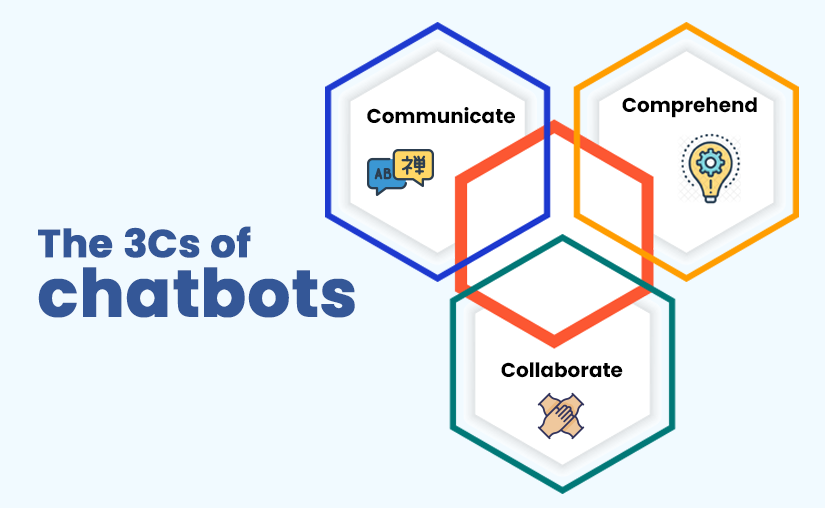

However, chatbots work on a programmable knowledge base and cannot understand the context. This is where virtual agents or insurance conversational AI assistants come into their own. Conversational AI also pulls from the same knowledge base but they have an additional Natural Language Programming Layer that is a customized algorithm that trains the virtual assistant on past information as well as makes it sound more human. Consider this situation: a chatbot bot might not understand the angry response of a user and start the conversation with a “Hello and hope you are having a good day”. A virtual assistant will pick up on the anger and say” I’m sorry you’re facing this problem. How may I help you?”

Chatbots are definitely more advanced than 10 years back and their ability to understand customer needs will keep getting more advanced. There is a caveat here, however human-like their responses may be, the customer must always be informed that they are conversing with a bot and not a human agent.

Conversational AI as a partner to insurance agents

A paper published by OpenAI suggests that Large Language Models (LLMs) could play a substantial role in shaping the future of work. While customer service virtual assistants might be getting the spotlight, underwriting AI assistants are projected to take a slice of the pie with a CAGR of 30.6% from 2023 to 2032

Tara, the interactive smart bot from SImpleSolve can prompt agents in real-time about high-risk concentrations just as the agent is quoting new business or she could alert that the NB the agent is quoting to was a prior insured with claims. Agents are expected to know it all - the specification of various insurance policies, their coverage, premiums, pricing, term limits, and renewal process. It is difficult for agents to keep up with product updates because there is other information that is coming in as well. They are expected to keep track of promotions, discounts, and new announcements. They often are bombarded with information from emails, portal notifications, and more. In this sea of noise, it can get challenging to find the information when they need it instantly.

Smart BOTS like Tara, can automate routine tasks and trigger transaction workflows with the Bot becoming the interactive display, assisting the agent with stats, showing disclaimers relevant to a customer, and upselling based on data in the insurance application.

Self-servicing through embedded chatbots on insurance portals

Geico uses a virtual assistant to greet customers and offer help with insurance products or policy questions. A customer service chatbot is a great tool to explain insurance plans. By asking qualifying questions, the virtual assistant can learn the customer’s needs and then recommend suitable plans. Many rule-based chatbots run on such prepared scripts. This is most effective for simpler plans like travel insurance and auto insurance where an embedded chatbot can take a customer through the entire insurance purchase journey themselves. Rule-based chatbots are easier to train and integrate well with legacy systems.

Intelligent chatbots are a more sophisticated cousin to rule-based chatbots and use natural language processing NLP, AI and ML - the same technology that powers generative AI, the technology behind Conversational AI models like ChatGPT. Although Voice AI can take longer to train and need large volumes of data to hone their skills, they save time in the long run. They keep learning from information gathered, understand patterns of behavior, and have a broader range of decision-making skills.

For successful outcomes in these use cases, there is an underlying criterion. In insurance, a chatbot should ideally connect with all internal systems but that might be a tall order. Definitely, they need to connect with key systems to get the most value in bot-customer interactions. For example, they should integrate with document management tools, policy management software, CRM systems to track customer interactions and feed into sales pipelines. Finally, conversational AI bots will also need to connect with claims software.

This blog is the 4th in the series we are covering about 7 technology trends reshaping insurance.

-

Intelligent automation in core functions

-

Collaboration with ecosystem players

- CARE-based digital tools for improved CX

-

Chatbots that will take over 95% of customer conversations

-

The growth of usage-based insurance models

- Big data usage for climate risk modeling

Topics: AI Chat Assistant