Insurance Technology Trends: Top Intelligent Automation Use Cases

Intelligent automation trends are driving a major transformation as insurance companies navigate the complexities of a digital-first era. Many insurers are integrating AI and data analytics through Business Process Management (BPM), chatbots, and customer portals to boost cost efficiency and enhance customer service. This shift towards AI-driven policy calculators and automated application processes represents a significant change from an industry that till now was heavily reliant on paperwork.

Many insurance companies face challenges in implementing digital technologies enterprise-wide on their legacy platforms, limiting their growth.

A 2024 survey of 100 Chief Information Officers from insurance firms highlights the progress and challenges in modernization efforts. The survey found that only 20% have partially completed their technology initiatives, and a mere 12% have fully completed all their projects. Over two-thirds of these firms are currently in the process of implementing or planning these upgrades. This is a clear indication that if your company is not planning on intelligent automation then you risk being left behind.

Take a look at the other insurance technology trends that are shaking up the industry.

-

Property and Casualty Insurance Technology Trends for 2024 and Beyond

-

AI Chatbots that will take over 95% of customer conversations

- Collaboration with ecosystem players

How Intelligent Automation is transforming insurance

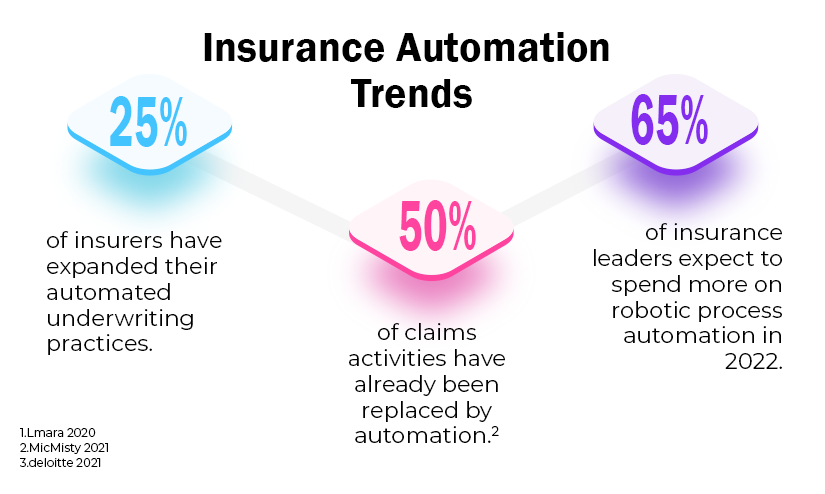

Recent research by McKinsey indicates that by 2025, 25% of the insurance industry is expected to be automated using AI and machine learning techniques. As AI in group insurance sales and underwriting advances and carriers gain access to new data sources, many roles will be upskilled and adjusted to accommodate new technologies and methods of working, rather than being replaced.

AI can automate submissions underwriting, handling many mundane and time-consuming tasks such as converting raw data from RFPs into structured formats and manual data entry. This automation enables skilled underwriters to focus on more urgent and important work.

RPA was the early rule-based automation process that speeded up repetitive processes that are part of every insurance workflow. But even this had very few takers in the earlier years. A survey conducted by Statista in 2018 had only 5% of insurance company responders say that they were using robotic process automation in selected claim and underwriting processes. Compare this with a 2024 survey of 580 U.S. executives in banking, credit unions, and insurance found that they rated automation's importance to their organization's success at an impressive 8.5 out of 10.

What is Intelligent Automation?

Intelligent automation (IA) goes by a few other terms like hyperautomation or cognitive automation. The hyperautomation technology combines Robotic Process Automation RPA (it is rules-based) with AI technologies such as machine learning, natural language processing (NLP), OCR or computer vision. Automation that is intelligent enough to learn as it goes brings decision-making based on big data into core functions. IA is the decision-maker and RPA provides the muscle.

Intelligent Automation Use Cases That are Transforming Insurance

Here are some top use cases where intelligent automation will have the greatest impact in 2024 and beyond.

Increasing automation in underwriting

In the P&C insurance space, ‘smart’ underwriting will be the success differentiator for carriers primed for growth. The underwriting operations are already under pressure to reduce costs while speeding up what is generally a lengthy process. Further, many companies realize that their underwriting systems need a more modern underwriting capability supported by better data platforms. There is also a growing need to innovate because carriers are seeing new distribution channels evolving and there is also a threat from OEMs stepping into the insurance space. Customers themselves are becoming more comfortable with digital shopping for insurance. Finally, massive amounts of data are now available to underwriters and new core platforms are making it accessible. These changes are pushing underwriting out of the familiar policy administration mode.

Implementation of intelligent AI-driven solutions to automate insurance underwriting will speed up data collection, loss assessment, customer claim history review, and more.

Automate submissions underwriting:: An insurance automation example to explain the benefits can be seen in new submissions. Automating submissions underwriting process involves bots parsing emails to retrieve underwriting documents (using NLP), extract the required information, cross-reference with external data sources, and validate the submission applications for completeness. This makes new submissions be processed four times faster.

Overall intelligent automation can improve accuracy rates by up to 90%. Speed up service delivery by 80%. Increase business productivity and profitability by 50% and achieve almost 100% regulatory compliance.

Speed has become an essential commodity for improving the customer experience. Millennial insurance customers want to be able to sign up for a policy in just 5 minutes and they want a completely digital experience. P&C insurers have to prioritize speed to compete if they want to stop customers from shopping around.

Also Read: AI for Insurance - Everything You Need to Know

Automating claims management for speed and accuracy

Annalise manages a team of insurance claims processors. They go through 20+ checkpoints for all incoming claims - validate the information of the insured, verify the coverage, and consult with data science specialists and investigative units before reaching a decision on settlements. It is an incredibly complex system that whirs into motion for each claim submission. The complexity is also what makes it very time-consuming.

Now picture this same process when intelligent automation is brought into the mix.

An insurance claims dashboard automatically validates all the details and coverage even before the claim is assigned to Annalise’s team. As the claim moves through the automated workflow, inputs are added on such as red flags from fraud detection algorithms, and comparisons with relevant external data such as weather analysis or traffic details. Information is automatically generated through predictive models that analyze information such as crash images uploaded by the claimant and drill down into the images. This is just one of the many automation examples that show how AI and a digital workforce can combine and work together to create a better claims process.

When files are digital and are available on the cloud, they can be analyzed using machine learning algorithms that are preprogrammed. This improves both speed and accuracy. Such an automated review not only impacts claims but also policy administration and risk assessment.

Policy management and IA

The whole cycle of policy management operations is an important intelligent automation use case. At the stage of policy issuance, the underwriting pre-checks have been completed and the underwriting decisions have already been made. The policy is ready to be issued, information has to be updated in the internal systems and the customer has to be informed. While this sounds like a fairly simple process, it is anything but and has a lot of manual work involved.

Prebuilt RPA and AI in the policy management software, as provided by SimpleSolve’s suite of services, ensure an end-to-end digital integration of the insurance business. Further, the analytics derived from the policy data becomes the base to automate decision-making. An automation example in support of this can be found in the endorsement request intake and routing. Inbound requests can come from customers, agents or brokers through emails or voice transcripts (phone calls) - unstructured data. Machine learning can identify and extract the inbound change requests. The bots can classify the supporting documents and extract key data points from each of these documents. The bots then turn the extracted data into structured information that can then automatically perform the required edits to the policy system.

Emerging digital technologies integrated into modern insurance policy administration software like SimpleINSPIRE (from SimpleSolve) also automate the real-time report generation process.

The intelligent automation market is predicted to explode in popularity with the digital workplace undergoing many changes. Institutional insurers have the advantage of the longstanding trust and scale that they have earned through the years. If they increasingly integrate AI and emerging technologies across their operations, especially in augmenting their workers' capabilities, they will be able to be ahead of challenges from new market entrants who have digital capabilities but not the knowledge garnered through the years.

Topics: Intelligent Automation