Ultimate Guide to AI for Insurance - Everything You Need to Know

The insurance industry in America is undergoing a profound transformation, largely driven by the integration of Artificial Intelligence (AI). This integration is reshaping various aspects of the insurance sector, from underwriting and pricing to customer service and claims processing. From the traditional methodologies of actuarial practices to the innovative realm of dynamic pricing, and from leveraging the predictive potential of machine learning insights to seamlessly deploying AI-powered chatbots, the insurance sector in the United States is undergoing a technological revolution.

This comprehensive guide delves into the profound and far-reaching impact of AI on insurance technology in America, shedding light on key trends and applications that are rapidly reshaping the industry.

Table of Contents

Our experts help you navigate the ever-evolving terrain of insurance technology, armed with the insights from this Ultimate Guide to AI for Insurance.

1. Machine Learning and AI: Transforming the Insurance Industry

2. Actuaries and AI: Revolutionizing Data-Driven Insights

3. Dynamic Pricing in Insurance: AI's Personalized Premiums

4. AI Chatbots: Trends Reshaping Customer Interactions

5. Balancing AI Ethics and AI Innovation in Insurance

6. Tech Trends Reshaping Insurance: Intelligent Automation

7. Insurance IoT Applications in America: Exploring Possibilities

8. NLP in Property and Casualty Insurance

9. How Advancements in AI are Revolutionizing the Property Insurance Market in America

10. Blockchain and Smart Contracts: Insurance Technology Trend

11. Automated Underwriting and its Impact on Customer Base

12. Intelligent Process Automation in the Insurance Industry

Chapter1. Machine Learning's Predictive Power in American Insurance

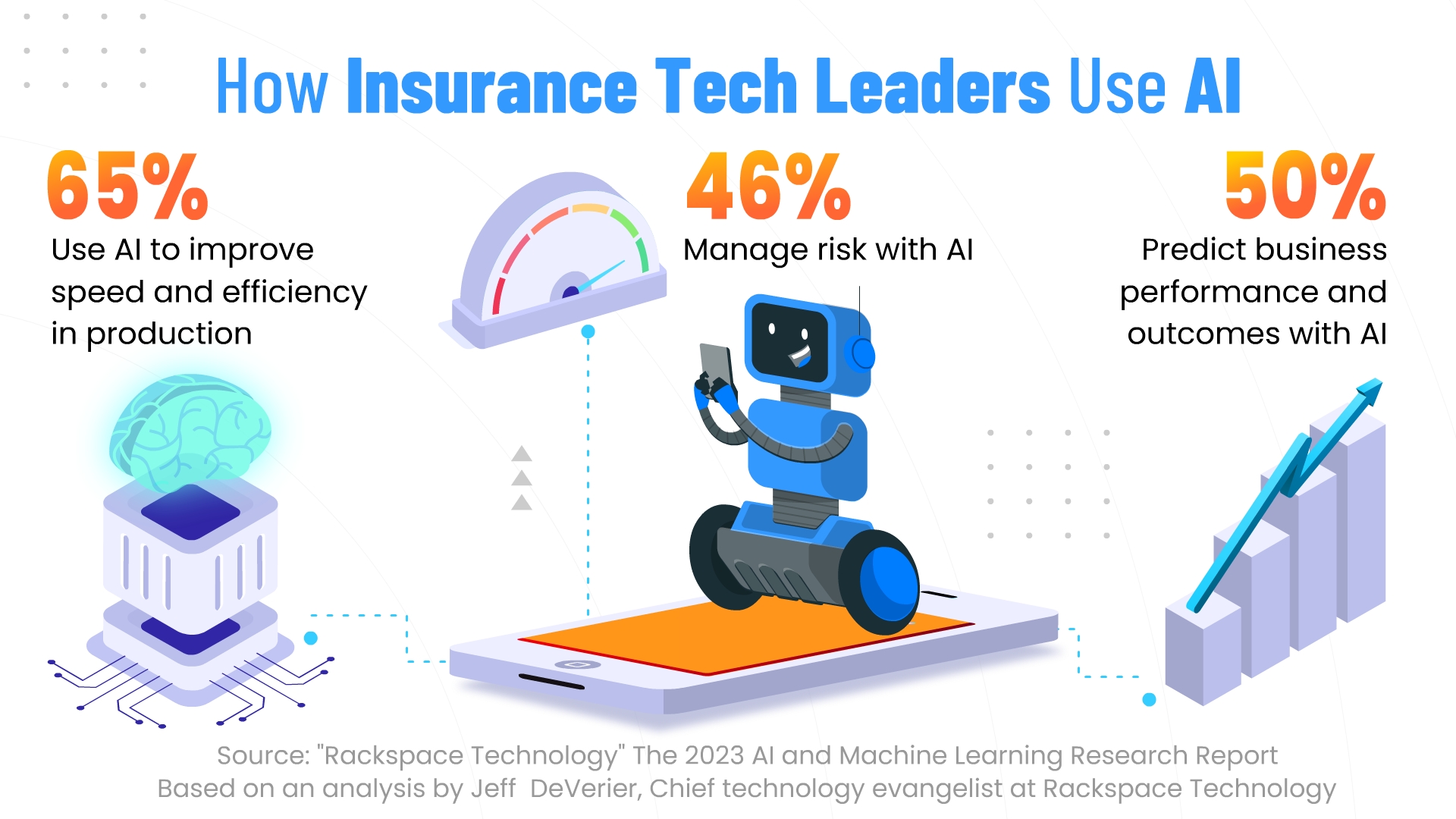

The hitherto untapped potential of machine learning within the U.S. insurance sector stands at the center stage within Machine Learning and AI in the Insurance Industry. Here are insights into how AI for insurance is helping insurers in strategically wielding sophisticated machine learning algorithms to project potential risks, deftly pinpoint patterns in fraudulent claims, and ingeniously streamline historically intricate underwriting processes.

The ramifications are profound, with insurers amplifying operational efficiency and substantially mitigating risk exposure, and delivering policy pricing that resonates more harmoniously with real-world dynamics.

According to McKinsey, digital claims, adeptly integrating machine learning, can reduce expenses by 25-30 percent by improving effective claim handling and increasing customer satisfaction.

Chapter 2. Actuaries and the AI Revolution: Data-Driven Insights

Traditionally responsible for assessing risks and meticulously determining premiums, actuaries are undergoing a paradigm shift fueled by the infusion of cutting-edge AI technologies. Barbara Shwarz, brings her 35 years in the insurance sector, including a stint as an actuary, into this insightful exploration of How Actuaries Are Embracing AI and Data Automation. She discusses how AI, data automation, big data analytics, and machine learning are not merely tools but are empowering actuaries with the capability to process unprecedented volumes of data.

This evolution equips actuaries with the tools to recalibrate their focus, leading to more astute risk assessments, more refined pricing models, and enhanced decision-making prowess. By embracing AI, actuaries are ushering in an era defined by data-driven insights that transcend and drive innovation across the American insurance landscape.

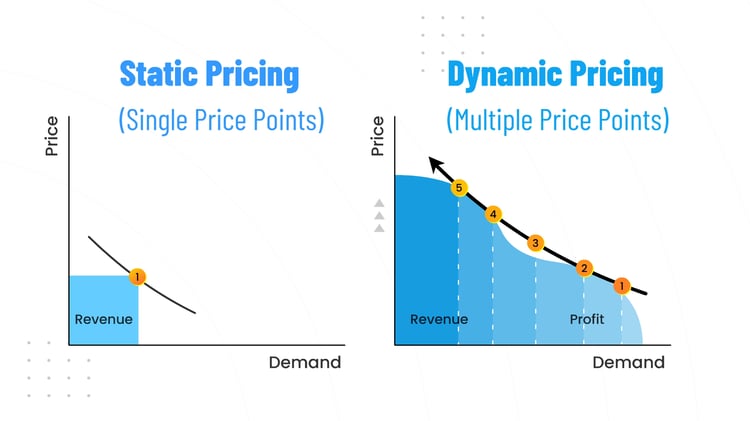

Chapter 3. Dynamic Pricing: Personalized Premiums Enabled by AI

The resounding concept of dynamic pricing in insurance has gained monumental traction within the United States, largely thanks to AI's exceptional knack for dissecting and interpreting real-time variables. Delve deeper into the intricacies of Dynamic Pricing in Insurance Using AI, a narrative that unravels the captivating insight of insurers harnessing AI algorithms to meticulously scrutinize an ever-streaming deluge of data, closely monitoring shifting market trends, and meticulously deciphering the intricate tapestry of customer behaviors.

The crux of this dynamic lies in an agile approach that empowers insurers to swiftly recalibrate their pricing strategies, offering an array of personalized and inherently equitable premiums that are intrinsically tethered to the nuanced risk profiles of individual customers.

A recent survey conducted by the IBM Institute for Business Value (IBV) highlights that 50% of customers now favor customized products. This serves as a clear indicator to insurers that the clock is ticking on outdated systems.

Chapter 4. AI-Powered Chatbots in Insurance: Ushering in New Customer Interactions

Chapter 4. AI-Powered Chatbots in Insurance: Ushering in New Customer Interactions

Embark on the journey to elevate customer experience - U.S. insurers are leveraging AI-powered chatbots as vanguards of a transformative revolution. Immerse yourself in the narrative presented by AI Chatbots: Technology Trends in Insurance, a narrative that illuminates how these intelligent digital emissaries are fundamentally reshaping interactions.

These AI-powered virtual assistants, like SimpleINSPIRE’S ‘Tara’, excel in addressing policy-related queries, facilitating seamless claims processing, and instantaneously responding to a plethora of inquiries. This strategic transformation frees up human agents for tasks that necessitate intricate cognitive dexterity.

In 2022, a substantial 88% of users engaged in at least one conversation with a chatbot. Moreover, a noteworthy 74% of customers indicated a preference for chatbots over human agents when seeking answers to straightforward questions.

Chapter 5. Navigating the Intersection of AI Ethics and AI Innovation

As AI spearheads transformative innovation within America’s insurance realm, ethical considerations emerge as a critical imperative. Navigate the intricate dynamics at play in The Balancing Act Between AI Ethics and AI Insurance Innovation, an exposé that unveils the collaborative endeavors aimed at harmonizing cutting-edge innovation, data privacy concerns, and the imperative of responsible AI deployment.

In this article, Antony Xavier, CEO at SimpleSolve, delves into the concerted efforts of insurers and industry regulators, as they collectively forge guidelines to ensure AI technologies are developed and harnessed in ways that exude transparency, uphold ethical values, and resonate with societal norms.

The 2023 legislative session has witnessed a significant uptick in the introduction of state AI-related laws across the United States, surpassing the quantity of AI laws proposed or enacted during previous legislative sessions.

Several states have put forth proposals to establish task forces aimed at exploring AI-related matters. Get the list of state laws going into effect.

Chapter 6. Intelligent Automation: A Tech Trend Evolution in the U.S.

Discover the profound confluence of intelligent automation in insurance applications within our article Tech Trends Reshaping Insurance: Intelligent Automation. Embark on a journey that uncovers how the partnership of AI and automation culminates in the optimal optimization of claims processing, policy administration, and risk assessment. This symbiotic blend translates into leaner operational costs, expedited service delivery, and the strategic rechanneling of resources for utmost efficiency.

In SimpleSolve's experience with our SimpleINSPIRE Insurance PLatform, companies have decreased document capture time from 2 hours to 10-15 minutes, streamlined employee handling time of documents from 3-5 times to once, resulting in a 75% reduction in claim adjudication time, and lowered customer inquiry calls by 25%.

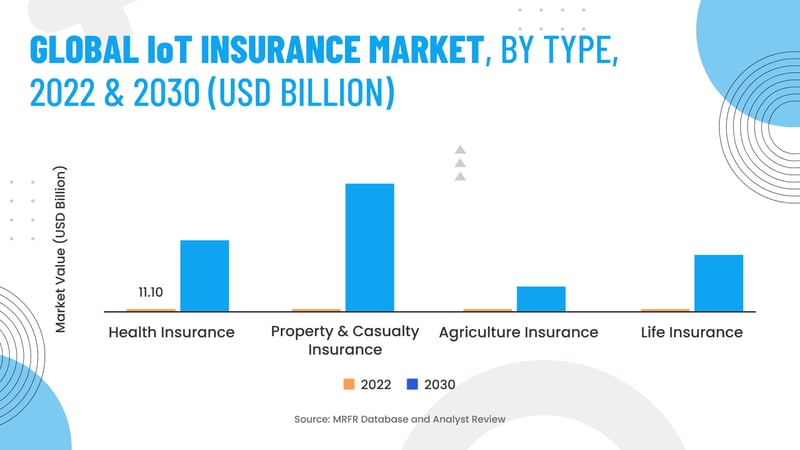

Chapter 7. IoT Applications: Transforming Data-Driven Insurance

Embark on an exploration of 5 Insurance IoT Applications in America to understand the monumental role that the Internet of Things (IoT) plays in revolutionizing risk assessment and catapulting customer engagement to unprecedented heights. This article meticulously unravels innovative use cases where IoT devices, ranging from vehicle telematics to state-of-the-art smart home sensors, conjure a myriad of actionable insights. The net effect? Enhanced risk assessment precision, proactive loss prevention, and an elevated capacity for U.S. insurers to meticulously tailor their insurance offerings.

Despite achieving customer claim cost reductions of 5% to 15%, automated claims processing using IoT data is not yet widely adopted, with only 21 percent of insurers utilizing real-time data generated from IoT devices.

Chapter 8. NLP's Role in U.S. Property and Casualty Insurance

Unearth the transformative potential of Natural Language Processing (NLP) within the U.S. property and casualty insurance realm, as we delve into Why Property and Casualty Insurance Needs NLP. This intricate narrative navigates how NLP technologies expertly extract layers of insightful intelligence from policy documents, claims reports, and the invaluable feedback of U.S. customers.

As an illustration, prominent language models such as ChatGPT (generative AI) have gained widespread recognition, facilitating the automatic comprehension of the semantic purpose of discussions. They excel at producing precise, impactful, and human-like responses in language-centric applications, effectively redefining the landscape of communication.

By enhancing the accuracy of information extraction, streamlining claims processing, and adeptly performing sentiment analysis, NLP in insurance ensures that property and casualty insurers meticulously optimize efficiency, accuracy, and customer satisfaction.

IBM approximates that up to 30% of a knowledge worker's day is devoted to searching for the information necessary to fulfill their job. Initiating a pilot project, such as automated text classification, can trigger a ripple effect across your entire organization, as it can be applied to most, if not all, of your departments.

Chapter 9. Transforming the Property Insurance Market in America through AI

Our guide to AI for Insurance dives into the property insurance market in America which is undergoing a remarkable shift due to advancements in artificial intelligence (AI). Explore this fascinating journey in How Advancements in AI are Revolutionizing the Property Insurance Market in America, where we explore how AI is reshaping risk assessment, claims processing, and customer interactions. Witness the rise of AI-powered algorithms that can predict property damage probabilities with unparalleled accuracy, leading to more precise underwriting and personalized coverage.

Join Chandra Mouli, Head of Innovation at SimpleSolve, on this insightful journey to discover the potent fusion of AI and property insurance, where innovation and efficiency converge to redefine the American insurance landscape.

By 2030, artificial intelligence will "increase productivity in insurance processes and reduce operational costs by up to 40%. - Precedence Research

Chapter 10. Blockchain and Smart Contracts in Insurance: Reinventing Transactions

The blend of blockchain and smart contracts is revolutionizing insurance transactions. The article Blockchain and Smart Contracts: A Top Insurance Technology Trend, delves into the concept of secure, tamper-proof transactions. Blockchain's transparency can be harnessed for streamlined claim settlement, where each step is recorded, reducing disputes.

Blockchain in Insurance - The decentralized ledger system ensures an unalterable record of transactions, enhancing data security and bolstering trust. Picture a scenario where sensitive policyholder data is securely stored on the blockchain, providing an indelible trail of interactions between insurers and clients. Read more about it in our article.

Smart contracts in Insurance use cases are extensive. Imagine a travel insurance claim automatically triggering based on a flight's delay, showcasing the real-time benefits of AI automation.

As the influence of blockchain in insurance continues to expand, its transformative power becomes increasingly evident. Join us in this exploration of the marriage between blockchain and smart contracts, where innovation harmonizes with security, reshaping the landscape of insurance practices in America and beyond.

Chapter 11. Automated Underwriting: Elevating Customer Base Quality

Automated underwriting is not only transforming customer acquisition but also risk assessment accuracy. The article Can Automated Underwriting Impact the Quality of Your Customer Base? explores AI's role in evaluating risk factors. Through sophisticated algorithms, automated underwriting assesses medical records and lifestyle data. For instance, AI can analyze health metrics and predict the likelihood of a policyholder developing chronic conditions, leading to more tailored policies.

In an underwriting survey with nearly 500 underwriters, it was found that up to 40% of their time is consumed by non-core and administrative tasks, - " shared by Corey Barker, Accenture

Chapter 12. Intelligent Process Automation: Streamlining Insurance Operations

Intelligent process automation (IPA) is reshaping insurance workflows through the amalgamation of AI and automation. The article Intelligent Process Automation in the Insurance Industry, explores how IPA optimizes tasks like policy renewals. For instance, an AI-driven IPA system can proactively identify soon-to-expire policies, generate renewal options, and predict personalized offerings based on historical data. This level of automation ensures timely renewals and customer satisfaction.

Also Read: New Policy Management Software: The Guide to Getting IT Right

In conclusion, the convergence of AI and insurance technology in America is shaping a more efficient, customer-centric, and data-driven industry. From transforming actuarial practices to revolutionizing customer interactions, AI's influence is undeniable, with the potential to drive innovation, improve risk assessment, and enhance the overall insurance experience for both insurers and policyholders.

Topics: A.I. in Insurance

.jpg)