After Selecting a Phenomenal Insurance Admin System Why Does Project Implementation Fail?

The National Flood Insurance Program in the United States has faced challenges in the ongoing modernization of its systems and processes. The goal was to improve policy administration, claims handling, and risk assessment. However, the implementation process has been slow and complex, leading to difficulties in updating flood maps, accurately assessing flood risks, and providing timely claim settlements. These challenges have created frustrations for policyholders and insurers alike.

Many insurance carriers have found themselves in the same tough spot. Why do insurers find themselves in such a situation after the long process of deciding on a vendor and going into implementation with understandably high expectations?

Why does insurance software implementation go wrong?

In the insurance industry specifically, a study by Ovum found that only 27% of insurers believed their policy administration system implementations were successful.

There can be several reasons why implementations of a core insurance system may fail, even after selecting what appears to be a phenomenal system. Here are some factors that highlight some of the common pitfalls and challenges that can lead to implementation failures in the insurance industry and other sectors. Core insurance implementation failures rarely include all but even a few of these can have a domino effect on the final result.

-

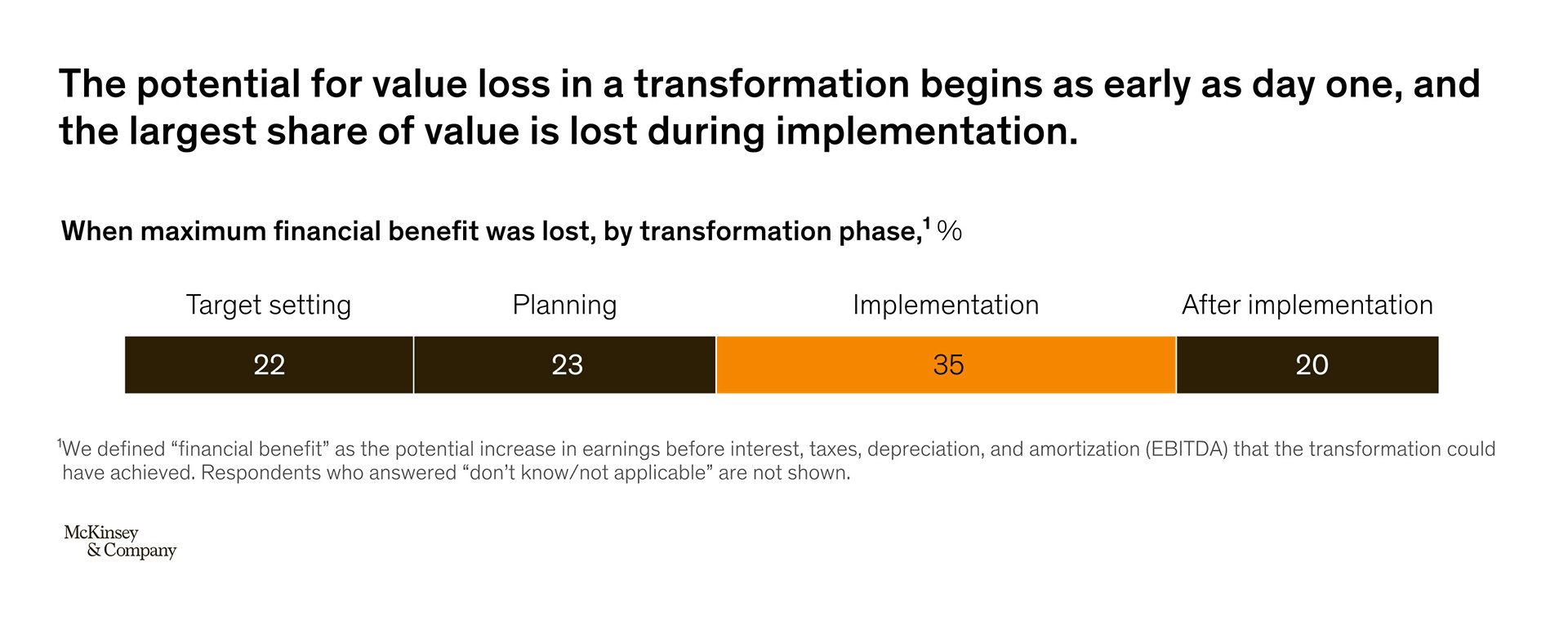

Inadequate planning during project implementation: Insufficient planning before the software implementation process can lead to a lack of clarity regarding goals, requirements, and expectations. Without a comprehensive plan, it becomes difficult to ensure that the system meets the specific needs of the organization.

-

Poor project management: Effective project management is crucial for the success of any implementation. If the project lacks clear leadership, communication, coordination, or proper allocation of resources, it can result in delays, cost overruns, and a failure to achieve desired outcomes.

-

Insufficient user involvement: It is not enough to set effective aspirations for the new implementation if your people do not know what they will need to do differently. Users of the Insurance software must be actively involved throughout the implementation process. Their insights, feedback, and requirements are essential for ensuring that the system aligns with their needs. If users are not adequately involved or their feedback is not considered, the system may not be accepted or utilized effectively.

A McKinsey survey says that almost 20% of senior leaders believe that their people have been kept fully in the loop, yet therein lies a perception gap that can affect successful outcomes.

-

Inaccurate requirements gathering: If the requirements of the insurance administration system are not properly gathered, documented, or understood, it can lead to the implementation of a system that does not address the organization's needs. This can result in dissatisfaction, poor usability, and ultimately, project failure.

When SimpleSolve stepped in with our SImpleINSPIRE core platform, we were told that in an earlier implementation of a claims management system for an insurance company, the project team failed to gather comprehensive requirements from various stakeholders, including claims adjusters, underwriters, and customer service representatives. As a result, the system did not adequately support the specific workflows and processes of these stakeholders, leading to inefficiencies, user dissatisfaction, and a failed implementation.

-

Lack of training and support after project implementation: A phenomenal system alone does not guarantee success. Insufficient training and support for end-users can hinder adoption and utilization. If users are not adequately trained on how to use the system or do not receive ongoing support, they may struggle to embrace the new system, leading to implementation failure.

An insurance company implemented a new customer relationship management (CRM) system without providing sufficient training and ongoing support to its agents. The agents struggled to understand the new system's features and functionalities, resulting in low adoption rates and limited utilization. Ultimately, the implementation failed to improve customer service and operational efficiency as intended.

-

Data migration challenges: The transition from an existing system to a new Insurance system often involves data migration. This is a vital component for successful implementation. Without data and specifically the right data, the implementation is doomed for failure. If the data migration process is not properly planned, executed, and validated, it can result in data inconsistencies, loss, or corruption, impacting the system's functionality and reliability.

A P&C insurance company decided to replace its legacy claims system with a modernized platform. However, during the data migration process, numerous data inconsistencies and errors emerged, impacting claims processing and customer service. Additionally, the integration of the new system with existing systems, such as provider networks and billing platforms, encountered technical challenges, further hindering the implementation's success.

-

Integration complexities: Insurance organizations typically rely on multiple systems and interfaces. Integrating the new insurance software with existing systems can be complex and challenging. Inadequate integration planning, technical difficulties, or incompatible systems can impede the implementation's success.

-

Resistance to change: People naturally resist change, when it disrupts their established routines and processes. If there is a lack of organizational buy-in or resistance from key stakeholders, it can undermine the implementation efforts, hampering the system's adoption and effectiveness.

-

Vendor-related issues: Even if the insurance administration system is considered phenomenal, , when business cultures do not align, problems with the vendor can contribute to implementation failure. Problems such as insufficient vendor support, delays in addressing critical issues, or inadequate product quality can significantly impact the implementation process.

An insurance agency selected a promising agency management system from a vendor. However, after the implementation started, the vendor faced financial difficulties, resulting in reduced support and delayed product updates. As a result, the agency struggled with system bugs, lacked critical functionalities, and faced challenges in integrating the system with other tools. Checking the financial stability of your vendor is important before getting into a long implementation process. Here are 5 ways to conduct vendor due diligence during the scouting stage for modernizing your insurance software.

-

External factors: Unforeseen external factors, such as changes in regulations, industry dynamics, or technological advancements, can affect the success of an implementation. If the Insurance Administration system cannot adapt to these changes or the performance lacks flexibility, it can lead to failure.

To increase the chances of a successful implementation, organizations should invest time in thorough planning, engage stakeholders effectively, ensure comprehensive training and support, conduct proper data migration, address integration challenges, manage change effectively, and carefully evaluate vendors before selecting a system.

Also Read: New Policy Management Software: The Guide to Getting IT Right

You Need Insurance Expertise not Just IT Experts

Insurance is a complex and highly regulated industry with unique business processes, terminology, and requirements. Not all insurance vendors understand the intricacies of the industry, including policy administration, claims management, underwriting, compliance, and regulatory considerations. SimpleINSPIRE is a core insurance platform developed by insurance professionals for insurance professionals. Our deep understanding of insurance allows us to design and develop solutions that align with industry best practices and meet the specific needs of insurance organizations. This is a powerful fail-safe methodology paired with our agile principles that deliver projects always on time.

SimpleINSPIRE is based on the latest technology, backed by 20+ years of production experience, and architectured to continuously leverage emerging technologies through innovation and integration.

Don’t be a statistic instead be assured of a successful implementation, talk to us today.