6 Ways Machine Learning in Insurance is Transforming the Industry

AI and Machine Learning in Insurance are taking big steps forward and insurers aren’t shying away from it either. According to the KPMG Global Tech Report 2023, 52% of respondents identified AI, including machine learning and generative AI, as the top technology to help them achieve their goals over the next three years. Additionally, the KPMG 2023 Insurance CEO Outlook reveals that 58% of insurance CEOs are optimistic about seeing a return on their AI investments within five years, while 23%are expecting a return on investment in 1-3 years. As an insurance company where are you on this timeline?

Machine learning in the insurance industry

In the American insurance industry, the momentum toward adopting AI is accelerating at an impressive pace. Recent data reveals that 59% of companies currently exploring or deploying AI have accelerated their rollout or investments in this technology. This surge in AI adoption underscores a growing recognition of its transformative potential in the insurance sector.

Although today’s use cases for AI and machine learning in insurance are becoming more varied, process automation remains their most common application. According to an IBM survey, 33% of respondents across various industries rely on AI to automate IT processes. This trend is also evident in the insurance sector, where AI-driven solutions are increasingly used to streamline operations, from automating claims processing to optimizing underwriting tasks.

Machine learning algorithms play a pivotal role in this evolution. These algorithms possess the remarkable ability to foresee future outcomes, identify anomalies, and streamline various insurance processes through data-driven learning. AI ML in insurance leverages historical data specific to the domain. These algorithms unravel patterns, uncover correlations, and spot trends that might elude human analysts.

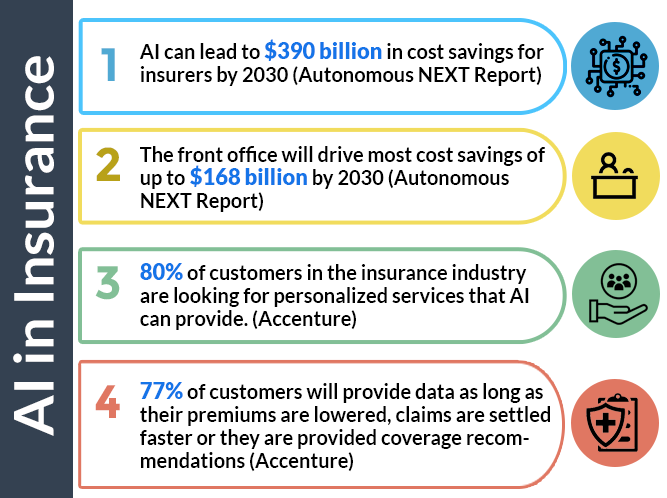

The insurance sector has been sitting on a largely unused treasure trove of big data because it lies scattered across disparate systems. The implications of machine learning in insurance are profound. It goes beyond mere data analysis; it empowers insurers with invaluable insights for shaping pricing strategies, optimizing claims management, fortifying fraud detection mechanisms, and ultimately enhancing the overall client experience. In essence, machine learning and insurance have become inseparable partners in navigating the ever-evolving landscape of risk management and financial protection.

59% of companies currently exploring or deploying AI have accelerated their rollout or investments in this technology.

Areas for transformation

With the global AI market estimated to grow at a CAGR of 42.2% to $733.7 billion by 2027, AI and machine learning use in insurance are only bound to grow. Based on current trends, here are 6 ways in which AI and machine learning may find fast-tracked adoption in the insurance industry

1. Machine Learning in Insurance Underwriting

The underwriting process in insurance depends heavily on data and analytics. It involves risk analysis and pricing, making underwriting an integral part of the insurance process. Traditionally, this vital task was entirely dependent on humans. Using Insurance machine learning, the process of underwriting has become easier, quicker, and more accurate.

Intelligent underwriting algorithms can analyze customer information to create reliable customer profiles and detect risk more efficiently. Some uses of AI for risk analysis are

-

Photo analytics to verify damages for property and vehicle insurers

-

Geospatial imagery for property risk analysis, deep learning- and data science-driven risk comparison systems. Insurance companies can reduce risk exposure as well as improve the pricing mechanism of policies.

-

Machine Learning in insurance underwriting will move the benefit along to customers by charging the right rates for each applicant – personalization at its best.

Also Read: The 4 Disruptive Technologies Reshaping Insurance Operations

2. Improved claims management

Claims management, though an integral part of the insurance industry, is a convoluted and cumbersome process. Settling a claim involves processing swathes of data and interacting with many stakeholders such as the claimant, insurance agent, underwriters, brokers, and financial institutions. AI/ML applications can automate routine data checks as well as interactions, clearing up time for agents to focus on other important tasks.

Claims management software can streamline end-to-end processes, right from data scanning and processing to verifying policy details and identifying gaps or errors.

For example, Japanese insurance company Tokio Marine incorporated an AI-based claims document system to upload handwritten notices onto its cloud-based system. Due to the advances in machine learning and natural language processing, this AI-based system reduced input time by 50%, cut human error by 80% and fast-tracked claims payments for the company.

Another advantage of ML applications in claims management is the increased data security for customers. Using these advanced technologies, insurance companies can make the claims management process hassle-free.

Also read: Everything You Needed to Know About AI for Insurance

3. Fraud detection using insurance machine learning algorithms

In the United States alone, insurance fraud (non-health insurance) costs the industry over $40 billion in losses each year (Fbi.gov stats). From premium diversion to impersonation; scammers use numerous ways to commit insurance fraud. Insurance fraud detection using machine learning can be an efficient way to identify these scams.

Deep anomaly detection is a popular ML application to detect fraud. By analyzing large data sets of genuine claims, Insurance machine learning models train to identify typical insurance claims. Any deviation from typical claims will be flagged as potential fraud, thereby enabling insurance companies to reduce risks and costs related to fraud and achieve superior results.

To cite an example, one of Turkey’s largest insurers, Anadolu Sigorta, had a team of 50 people to check every claim using a set of loose rules and their own personal experience. The predictive analytics tool in the software-enabled real-time risk assessment speeded up the process and reduced errors. After the change, Anadolu Sigorta insurer saw a 210% ROI within a year of switching to the AI solution.

Also Read: The Rise of Open API Ecosystems is Making Insurance Processes Bullish

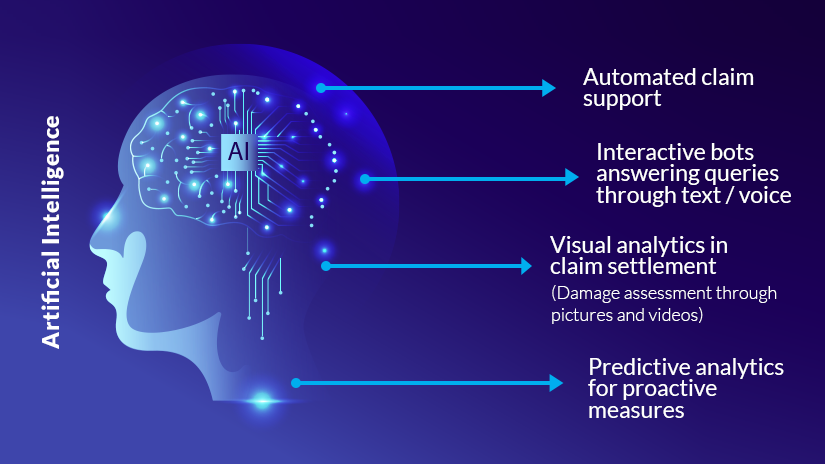

4. Better customer support in insurance

Have you ever been confused about the difference between machine learning and artificial intelligence? Machine learning is a subset of AI, where machines continuously learn from past data without any explicit programming. However, if there is any change in customer behavior, for example, then the algorithm has to be fed with the new data to build new patterns.

Artificial Intelligence, on the other hand, is used where adapting to new scenarios is required, AI is smart and can teach itself. Deep learning in insurance combined with other applications like interactive bots can improve customer-facing operations multifold. For instance, AI-based chatbots can provide speedy responses to routine insurance queries with higher accuracy than human agents. In fact, 40% of customers don’t realize that it isn't a human answering their questions in the online chat.

Additionally, using chatbots, insurance companies can save almost $1.3 billion by 2023 across motor, life, property and health insurance, according to Juniper Research.

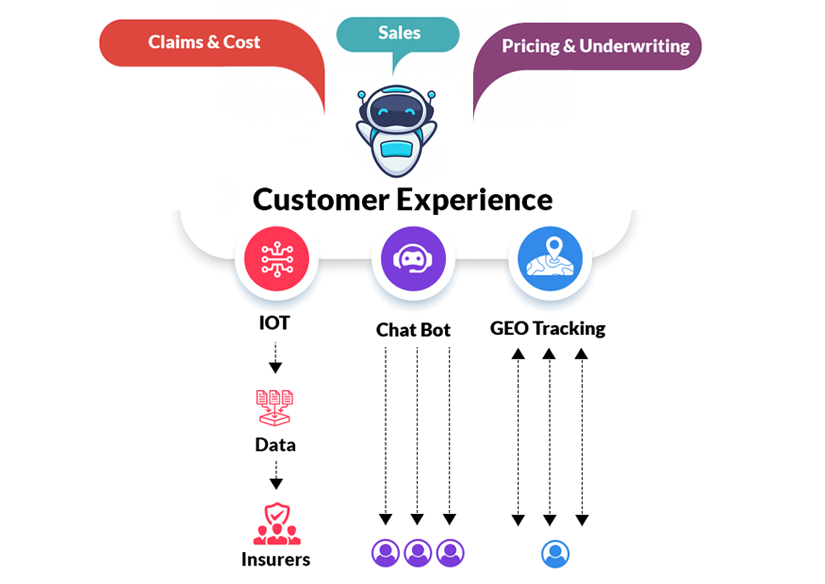

5. New business and lead generation

AI software can help marketers collect and analyze valuable information from different sources such as website visits, chatbot conversations and social media channels. This data, when combined with tailored lead interactions, personalized recommendations and timely suggestions can help drive new business. AI software can not only point out potential leads but the best ones can also indicate which customers are ready for a sale.

Using NLP and deep learning in insurance helps in analyzing large amounts of routine conversations. The chatbots can collect data around individual preferences, behaviors, past purchasing habits, age groups, and income, all of which can help provide personalized product recommendations. This also opens up possibilities for cross-selling and upselling policies.

6. Enhanced regulatory compliance

The regulatory landscape of the insurance industry is complex and ever-changing. One of the biggest challenges that insurance companies face is keeping pace with regulatory changes and incorporating these into policies. For instance, the relatively new regulations of the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) have raised the stakes for data protection and privacy for insurers. NLP technologies can help scan internal policies as well as claims documents to check their compliance with different regulatory policies.

When it comes to data privacy, you can easily set up automated routines to spot and strip out personal identifiable information (PII) when it’s not needed. This ensures that sensitive data stays put in a secure environment, keeping everything locked down and protected.

AI and ML in insurance can augment human intelligence to help companies avoid regulatory missteps that could cost them millions in non-compliance penalties.

The final word

If Google or Amazon were to venture into the insurance industry, imagine what a shake-up that would be because of their advanced technology. This should be a major driver for insurance carriers to adopt modern technologies to cope with industry setbacks, and keep ahead of competitors while also improving their productivity.

Topics: A.I. in Insurance

.jpg)