Digitally Transforming the Claims Process By Going Beyond the Traditional

It is a universally held belief that filing an insurance claim is a daunting process. It always accompanies a crisis and it is understandable why it is both the most visible and hated part of the insurance process.

Millions of insurance claims are filed every year. If you own a car, you can expect to file at least 3 auto insurance claims during your lifetime. Then factor in all the other insurance policies you need to take. This makes it vital for insurance carriers to harness new technology to make the insurance claims process less frustrating for both policyholders and insurance professionals.

Customers are getting more comfortable with digital tools and automation of processes can help harness customer loyalty. After all, if there is less pulling your hair out in frustration and more of it’s all a piece of cake - insurance carriers will reap the benefits.

There are numerous cogs that pull together in a digital claims process

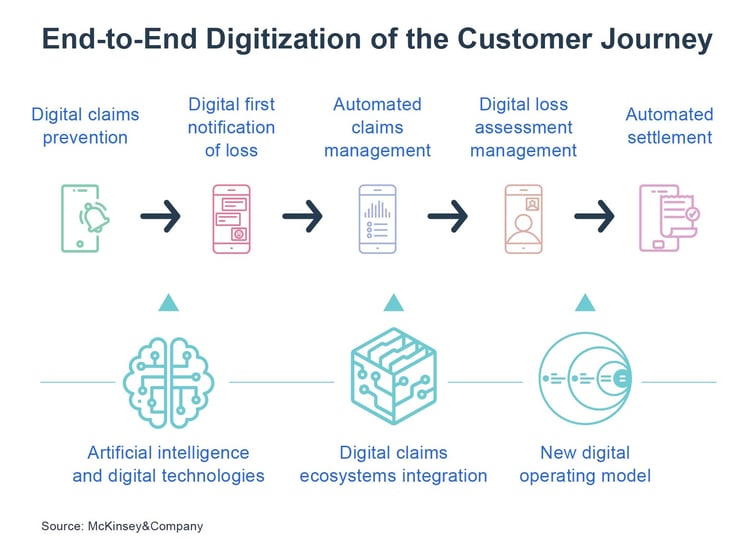

Since filing a claim is the reason to have insurance, claims management becomes an essential part of the customer experience. When digital automation is included in claims processing, the process can be significantly transformed from the traditional manual process.

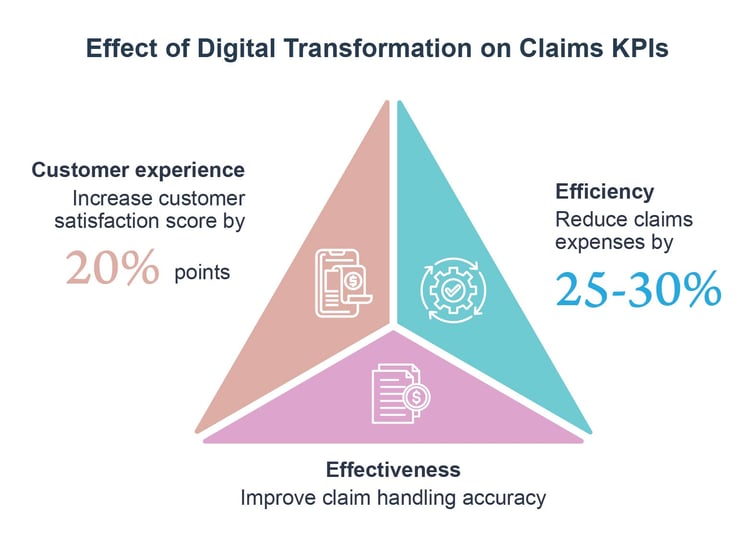

A digital claims process is all about integrating digital capabilities into an organization’s existing claims processing activities. What this does is transform the current product-oriented organizational model that is largely prevalent into a service-oriented one. Insurance carriers have seen a number of positive effects gained from this new model, particularly in the fierce competition for low-risk customers.

Here are some examples of how digital automation can improve every stage of the claims processing process:

When filing a claim

Instead of calling, emailing, or filling out a paper form, policyholders can file claims through a mobile app or online portal, which can be integrated with automated chatbots or virtual assistants to provide real-time support and guidance. Customers expect 24/7/365 access to all critical services and to meet this expectation requires insurance customers to be able to file a claim through a device of their choice on the web or mobile.

Most customers are aware that some claims do fall into the more complex bucket, however, they have high expectations that low-complexity claims be handled quickly.

During claim verification

Instead of assigning a loss adjuster to investigate the claim manually, insurers can use automated algorithms to analyze data patterns and detect potential fraud or anomalies. For example, automated image recognition software can analyze photos of damaged properties to assess the extent of damages and expedite the claim validation process.

In claim evaluation

traditional methods rely solely on claims adjusters to evaluate the claim, instead, insurers can use automated algorithms to analyze data patterns, predict outcomes, and determine settlement amounts. For example, machine learning algorithms can analyze past claims data to predict the likelihood of a claim being fraudulent or the expected cost of a settlement.

During settlement

Instead of manually issuing a settlement offer, insurers can use automated claims software and ML algorithms to generate settlement offers based on the evaluation of the claim. Policyholders can review and accept the offer through a mobile app or online portal, reducing the need for phone calls or emails.

Finally, claim closure

Finally, instead of manually closing the claim, insurers can use automated workflows to route the claim to the appropriate department for final review and closure. Policyholders can receive their settlement amount through electronic payment systems, reducing the need for paper checks.

Digitally transforming claims operations requires going beyond traditional methods and embracing technological advancements to enhance efficiency, reduce costs, and improve customer experience. In Simplesolve’s experience with our clients, a digitally forward insurance platform should be able to unleash truly transformative business models.

Machine learning as the superpower for claims teams

Claims adjusters have to do a juggling act - they spend most of their time on the go, inputting information into a variety of devices, laptops, cameras, etc. What if we could smoothen out some of these processes, particularly the rather frustrating paperwork involved?

In 2020, California experienced one of its worst wildfire seasons in history, causing significant property damage and leading to a surge in insurance claims. To handle the high volume of claims quickly and efficiently, some insurance companies turned to ML and AI.

For example, Farmers Insurance used a virtual claims adjuster called 'Dorothy' to process claims related to wildfires. Dorothy, powered by AI, could analyze property damage photos submitted by policyholders and provide an estimate of the repair costs. This allowed Farmers Insurance to process claims more quickly and reduce the need for in-person inspections that would otherwise have held up the process.

Another company, Hippo Insurance, used satellite imagery and ML algorithms to analyze properties affected by the wildfires. This hastened the process of assessing the extent of the damage and identifying claims that required immediate attention. Hippo Insurance also used chatbots to interact with policyholders and answer their questions, providing a faster and more efficient claims experience.

Machine learning in insurance is a superpower in the claims process because it can analyze vast amounts of data quickly and accurately, making it possible to identify patterns and anomalies that might be missed by human experts. By training algorithms on historical claims data, machine learning models can learn to recognize patterns in claims that are associated with fraud, errors, or other issues. For example, they can predict which claims are likely to result in litigation, which claims are likely to exceed a certain threshold, or which claims are likely to result in high settlement amounts. This can help claims teams allocate resources more effectively and prioritize their workload based on the level of risk associated with each claim. This will save insurers millions of dollars every year.

Also of interest: Social Inflation in Insurance: Nuclear Verdicts Driving Up P&C Liability

The claims process already uses data from a large number of external sources. The auto insurance claims process gets vehicle values, other vehicular information, as well as socio-demographic information to inform repair costs. Integrating machine learning in insurance claims processing will help to link all these separate threads to predict future outcomes even more accurately. It’s like having your very own crystal ball to know the future.

Back-office claims process automation

Machine learning in insurance can also be used to automate many of the tasks involved in claims processing, such as gathering and analyzing data, communicating with customers, and making decisions about claims. By automating these tasks, insurers can reduce processing times and improve the overall customer experience, while also freeing up staff to focus on more complex tasks that require human expertise.

The customer expects to have a claim settled, quickly and efficiently. They want complete transparency through the claims journey. Would it not be more extraordinary for the customer to know that they can be guided in preventing a claim from occurring in the first place? In other words, reducing the occurrence of the first notice of loss FNOL. Many insurers offer supporting services that are essential inclusions in their claim prevention process. In short, digital transformation of the claims process is an amalgamation of increased touchpoints, advanced ML algorithms, automation, and partnering with third parties for support services such as risk management consultants, IoT device and drone providers, smart home devices, etc.

The customer expects to have a claim settled, quickly and efficiently. They want complete transparency through the claims journey. Would it not be more extraordinary for the customer to know that they can be guided in preventing a claim from occurring in the first place? In other words, reducing the occurrence of the first notice of loss FNOL. Many insurers offer supporting services that are essential inclusions in their claim prevention process. In short, digital transformation of the claims process is an amalgamation of increased touchpoints, advanced ML algorithms, automation, and partnering with third parties for support services such as risk management consultants, IoT device and drone providers, smart home devices, etc.

With all this being said, Machine Learning is not a magic formula that will pull out the right answer for every question like from a magician’s hat. It all comes down to the individual algorithms built and the accuracy of the data sets used in training - strengths and weaknesses can differ for each insurer. This requires an expert AI team to work with you.

The digital journey requires not only AI-enabled automation but also an IT infrastructure that will support it. The SimpleSolve team would like to demo our SimpleINSPIRE platform which has been efficiently innovating the Policy and Claims Management Platform for our clients. We have also partnered with Intellagents to bring 80+ AI tools to our platform.

Topics: Claims Management

.jpg)

.jpg)