What it Takes to Reduce Technical Debt in Insurance Systems

Technical debt matters because insurance runs on technology. Some technical debt is inevitable, but it moves from an important topic to an urgent one when it adversely impacts the balance sheet. When technical debt is steep, it can present substantial risk. Systems that are closed and unable to connect with the latest innovative platforms and third-party technology might be giving an impression of business as usual while piling up extra cost from inefficiencies. Managing technical debt in insurance systems needs to begin by understanding the impact it has on operational efficiency.

The new definition of technical debt

Technical debt is what you should be spending on innovation compared to the money you are currently spending on keeping inefficient systems running. Insurance carriers have accumulated a great number of different systems and different technologies over the years. Underlying all this is an undeniable truth, that it costs a lot of money to keep these systems going and is the reason it is considered technical debt.

Technical debt is what you should be spending on innovation compared to what money you are currently spending each year on keeping inefficient systems running.

Another way to look at it is the difference between an insurer with a high-performing tech stack and another with what has thus far been perceived as an ‘average' performing tech stack. If you are spending 70% on business as usual (BAU), 20% on innovation, and 10% on other incidentals, then you are part of the ‘average’ Insurers. Compare this with High Performing Insurers who spend 40% on BAU and 50% on innovation.

How can insurance technical debt be improved? Let’s look at underwriting as an example of existing technology that does not get the necessary support from innovation. Underwriters are always wanting more data to manage exposure and price risks. This new data is available but only if their systems can plug into the insights provided by InsurTech platforms through microservices.

However, transitioning from a legacy system where many systems have been bolted together, is not easy, not only because of allocating higher budgets but also due to the fear of anything being missed while making the switch.

This might interest you: Best-of-breed vs Integrated Systems: Which is Right For Your Company?

Steps to reduce Tech Debt in insurance systems

With cloud-based solutions, the insurance industry has the opportunity to leave technology to the experts and get on with doing what they do best. The best platforms allow us to configure the way we want to work and use open APIs to plug in any of the tools we need to do our jobs better and compete in the marketplace. This is what is described as an open ecosystem.

While InsurTech is an often-used term, Tech Debt has been a silent participant at the table. Insurance carriers want to invest in future-proof architecture and this means an open API and low code systems that can plug into a larger technology ecosystem. Changes in the tech stack are needed to make this digital transformation.

Also Read: P&C System Total Cost of Ownership – What Are All the Factors in Figuring This Metric?

Step 1: Calculate the interest paid on technical debt

Reducing technical debt has a tangible outcome. Paying back a debt always has an interest rate attached to it. If you pay it back fast enough, you save on the interest payments and this is what makes managing technical debt highly relevant.

It is important to quantify technical debt. Going back to the Average Performing Insurer who spends 70% of their IT budget on BAU compared to a high performer who spends only 40%. The 30% percent difference is the interest being paid each year (this involves higher support and maintenance costs, a larger number of resources, and security risks among other contributing factors). If the IT budget is $1 M then that works out to $300,000. Now compare this to a financial loan for the same sum that carries on an average 5.5% interest rate. That is about $55,000. This difference is the amount insurance carriers are losing through technical debt. Technical debt when factored in on the balance sheets is often acknowledged and managed proactively.

Step 2: What to keep and what to modernize

Modernizing core legacy systems is a hard call to make, particularly if legacy systems are reliable and stable as in a majority of cases. Most insurance carriers have heavily customized systems and are reluctant to let them go, even if the cost of servicing is pushing expenditure up.

Not being able to integrate with third-party providers for a digital transformation might not be a priority. However, this leaves insurance carriers far behind, as others move ahead, providing their customers a better digital journey.

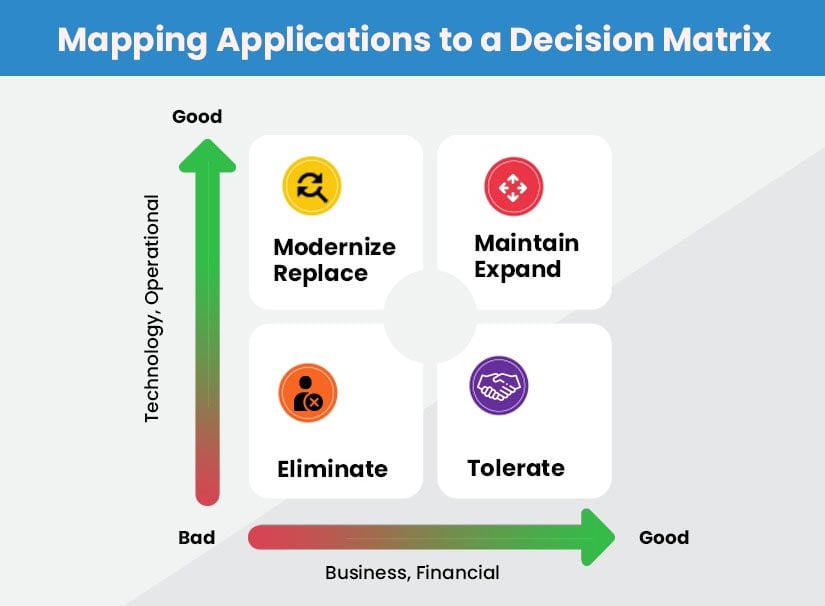

Evaluating what to modernize will need hard decisions to be made. Insurance carriers will need inputs from senior teams as well those working on it on daily basis, to evaluate systems based on the criteria detailed in Step 1. The list must be ranked by priority based on cost and urgency and then go into detailed research on what actions need to be taken in each group. For example, can fraud be lowered if policy management and claims processing link to FRISS? Could better business intelligence be possible if the system design allows being plugged into UrbanStat for data analytics?

The key innovation in the last 5 years, right across industries, has been the universal adoption of cloud technology which in turn has led to the open ecosystem concept. If your systems are not designed around this principle, it is time to introspect, evaluate, and modernize. Doing it all in one go is impossible. Every successful legacy modernization must have a long-term roadmap as well as a sound risk management program.

Replacing core platforms will have a higher investment cost but replacing them with a modern system is always better in a long-term valuation. However, in some instances, in-place IT modernization is also a possibility. Replacing a core system might sound like replacing a jet engine mid-air since processes still need to be functional. However, InsurTech companies are experienced in the smooth transitioning from existing systems to the new.

Step 3: Set milestones for success

Technology modernization can be too ephemeral an undertaking at the onset and justifying expenses in business impact and productivity gains are essential.

Mckinsey’s research has shown that when modernizing process technology is done right then there is a 40% decrease in IT expenditure and a corresponding 40% increase in productivity.

Measuring the success rate is important. One insurer group used standardized Key Performance Indicators (KPI) in their initial planning stage to retire redundant platforms and processes and reduce duplication of processes in different systems. The KPIs covered the target digital adoption rate, retention improvement, operations productivity improvement (eg. the increase in the number of claims processed per employee), and more. The goal they reached through this analysis was a 5% improved customer retention rate and a 20% increase in productivity savings by increasing automation and self-service. The improved efficiency was calculated based on the self-service model that reduced errors in data entry and improved faster processing time both in policy management and claims handling.

To conclude, it would be unrealistic to say that technical debt is nullified with legacy modernization. Tech debt is a necessary by-product of growth. Like a financial loan, it only becomes bad if you don’t pay it back. Recognizing when stop-gap measures are no longer good enough is vital.

SimpleSolve structures an application as a collection of loosely coupled and easily deployable services, making for easier in-place IT Modernization. Speak to us today to know more about how we have worked with insurance carriers in the United States to succeed in application modernization.

Topics: Legacy System Modernization