Best of Breed Software vs Best in Suite: Which is Right For Your Company?

When insurance carriers start on the path to deciding on a new solution, invariably the debate begins on whether to go for a best of breed software or an integrated do-everything solution also known as the best of suite.

In case you aren’t clear about the two: a best of breed system combines components that each focus on a separate functional area. A best of suite system provides many applications encompassing different functions, a common database, and also provides a consistent interface since it comes from the same vendor.

So which is the better solution? There is no right answer to that in the best of breed vs best of suite debate. It depends on your organization’s needs. It is comparable to whether your company prefers an open floor plan or a more structured layout with cubicles. Both are popular but companies choose to go for one over the other based on what works best for them.

The Best of Breed Approach

The best of breed approach came about as a response to the problems created by the monolithic legacy applications that were not able to cope with modern requirements. Best of breed works on the principle that no software can ever be the ‘master-of-all’. Instead, this approach recommends purpose-built systems that offer specialized functions. This means that an insurance carrier would have to purchase separate software from multiple providers for each application area.

Your policy administration software could be from Vendor A, client relationship management from Vendor B, and billing and insurance claims from Vendor C. You now have the best-in-class specialized software for each function and they need to be integrated As simple as it sounds, talking the same language might have its problems.

Here are the pros and cons of best of breed systems:

Pros of best of breed

-

Discover even more capabilities: The tighter focus on one core function means that best-of-breed systems often cover more facets of the problem than you need the tool to solve. While these additional capabilities are the key differentiators of the product, they come with hidden costs. Every additional tool brings with it additional infrastructure requirements that cause a ‘burdensome bloat’ and make businesses vulnerable to technology-induced disruptions.

-

Easier to implement and update: A stand-alone software solution addresses a specific core function, which in of itself may be quick to implement. System updates to that product, such as security patches or adding additional features can usually be rolled out with minimal effect on other systems unless the new features affect the other core systems requiring coordination of these changes.

Distributing responsibility to different providers can also lower the risk of vendors going out of business for any reason and the consequent lack of development support.

Cons of best of breed

-

Increases complexity: Insurance carriers may have to deal with multiple systems, multiple databases, and multiple vendors. Multiple solutions will also require managing multiple license agreements and more time spent managing different relationships with different providers

-

Integration challenges: To ensure compatibility and communication between different best in breed modules will require middleware and patches to ‘translate’ information between disparate systems. This is one of the downsides of best-of-breed vs integrated systems. The ability to share data across systems with ease should be evaluated when deciding on integrating a best in breed solution.

Also Read: Technology is at its best when it is invisible

Power of Best in Suite for insurers

As insurance systems become more complex with the need for digital transformation, the all-for-one ERP suites might no longer be the answer. Integrated system solutions for insurance have evolved and today will handle all core functionality while still providing flexibility to easily integrate with any third-party solutions.

Pros for integrated best in suite insurance solutions

Best of suite involves selecting a comprehensive software suite or package from a single vendor that offers a wide range of applications and modules to address various needs across the organization. In the insurance context, this suite might include modules for policy management, claims processing, underwriting, billing, and more.

The advantage of a best of suite approach is that the modules are designed to work together seamlessly, and integration is typically smoother. This can lead to more efficient operations and a consistent user experience across the organization.

Risk exposure is less. An integrated software suite acts like an umbrella bringing together all functions related to the insurance domain. This has the additional benefit of making data management much easier since it is centralized. since the database is not siloed, it gives real-time visibility and enables AI and automation more easily.

The Cons

However, the downside of best of suite systems is that they may not be the absolute best in every specific function compared to specialized best of breed solutions. Organizations may have to compromise on the depth of features in individual areas to gain the benefits of integration and a unified system.

Integrated insurance software contains multiple modules so implementation time can take upwards of 18 months depending on the complexity of the modules. Many of the integrated solutions can also cost upwards of a million dollars making it costly for smaller companies.

Solutions like SimpleINSPIRE’ Insurance Application Suite is both feature-rich, integrates with new age disruptive technologies, and takes less than a year to implement while costing is in 6 figures

Also of Interest: Why Technology Helps You Compete with Insurance Giants?

Which approach will your company benefit from? Best of breed vs Best of suite

The choice between best of breedvs best of suite systems would depend on various factors such as the company's size, business model, and specific needs. Here's a hypothetical scenario to illustrate which systems an insurance company could potentially opt for:

Hypothetical Insurance Company XYZ Insurance

XYZ Insurance is a medium-sized insurance company that offers various insurance products, including auto, home, life, and health insurance. They have a substantial customer base and aim to streamline their operations and enhance customer service. Here's how they might decide which systems to use:

Best of Suite Solutions:

-

XYZ Insurance may opt for a best of suite policy administration system. Since policy administration is a critical and complex function that requires integration with multiple departments (underwriting, sales, billing, etc.), a comprehensive suite will ensure seamless operations.

-

For claims processing, XYZ Insurance may also choose a best of suite solution. Claims involve a lot of coordination with policy data, customer information, and financial data, so having a claims system integrated with policy administration can be highly beneficial.

-

Billing is another area where a best of suite solution makes sense. It's closely tied to policy administration and claims, so a unified suite can help ensure accurate and efficient billing processes.

Best of Breed Solutions for XYZ insurance (hypothetical)

XYZ Insurance might opt for a best in breed underwriting system. Underwriting requires highly specialized risk assessment tools and analytics, and a specialized system could offer advanced features for assessing and pricing risks effectively.

Customer Relationship Management (CRM) - For CRM, XYZ Insurance could choose a best-of-breed CRM solution. CRM systems are designed to enhance customer engagement and retention, and specialized CRM software can offer more advanced customer analytics, lead management, and communication features.

In this hypothetical scenario, XYZ Insurance chooses a best of suite approach for core functions like policy administration, claims processing, and billing to ensure smooth integration and data flow between these critical areas. However, they select best-of-breed solutions for underwriting and CRM, recognizing the need for specialized, feature-rich tools in these areas.

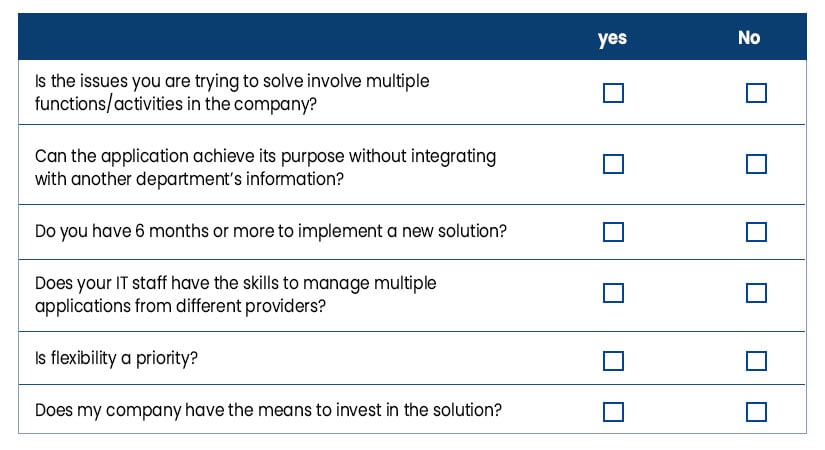

A short questionnaire might help you know what might work best for your organization

If you have answered ‘NO’ to a majority of the questions then probably best-of-breed might be the right choice. On the other hand, if you have answered ‘YES’ then an integrated solution might be what you should invest in.

If you have answered ‘NO’ to a majority of the questions then probably best-of-breed might be the right choice. On the other hand, if you have answered ‘YES’ then an integrated solution might be what you should invest in.

Ask for a consultation with our experts to get an additional perspective.

Topics: Legacy System Modernization