How Technology Helps With Standard ISO and AAIS Forms and Custom Forms

There is a reason, as all insurers know, why standardized insurance policy forms are necessary. The foremost is that every state has its legal requirements for insurance policies. Further, premium rates are based on actuarial studies of insurable risks and they also incorporate previous court rulings. Instead of 5000 Insurers, each having their analysis systems it is much more dependable leaving it to specialty organizations. This is why standard insurance policy forms (ISO Forms and AAIS Forms) are drawn up by insurance advisory organizations with no compulsion on the part of insurance carriers to use them.

However, customization and the addition of new features to meet new requirements are necessary. Proprietary forms in insurance can have more restrictive or even much broader terms than ISO or other standard forms.

Either way, is your insurance software system able to support your company with standard and proprietary forms? Before we look into the software side, a quick look into why ISO forms and even AAIAS forms can run into their thousands and the difficulty of keeping them organized.

AAIS vs ISO forms For Insurance Carriers

AAIS and ISO are pivotal players in the insurance industry, particularly in developing standardized insurance forms. In There is no real debate about AAIS vs ISO forms: AAIS focuses on crafting templates that ensure compliance, clarity, and comprehensive coverage for policyholders. Conversely, ISO offers a broader array of services beyond form development, catering to larger insurers and providing statistical, actuarial, and underwriting support. Both organizations contribute significantly to enhancing user experience and promoting uniformity within the insurance sector.

Also Read: Community Insurance Companies vs. Industry Giants - Strategies to Win

Custom Forms are Built on Standard ISO and AAIS Forms

Most insurance policies are standardized and are based on forms created by ISO or the American Association of Insurance Services in collaboration with ACORD.

While each state has its regulations, nothing stops insurance companies from creating customized forms that still meet compliance. Insurance companies have to go a step further than standard forms to stay competitive in the increasingly crowded insurance space.

Creating company versions of policy forms is both time-consuming and costly and presents risks of being interpreted differently by courts. ISO insurance forms and AAIS forms though have already been analyzed by courts and therefore, insurers tend to use the ISO language as a starting point, supplemented by add-on proprietary language when drafting custom broad or limited coverage forms.

AAIS is a leading provider of top-tier insurance forms, rules, and loss costs for the property casualty insurance sector. Governed by its member insurance companies, it's the sole national not-for-profit advisory organization. Over 700 insurance carriers nationwide rely on AAIS for high-quality policy forms and manuals covering Commercial Lines, Inland Marine, Farm and business lines, and Personal Lines.

ISO Insurance Forms Library provides thousands of filed advisory policy lines for 23 lines of insurance. The CGL line (Commercial Liability) alone has over 2000 policy forms and endorsements. The ISO insurance forms Library, on the whole, has upwards of 9000.

The Standards Form library runs to tens of thousands. ISO provides thousands of filed advisory policy lines for 23 lines of insurance. The CGL line (Commercial Liability) alone has over 2000 policy forms and endorsements and the library, on the whole, has upwards of 30,000.

In addition, AAIA maintains and updates forms and manuals for more than 25 lines of personal, commercial, Agricultural, and inland marine insurance.

Both standard forms and custom forms need to co-exist within the insurance system. However, these forms can run into thousands, and keeping them organized and updated is a feat in itself.

Also Read: New Policy Management Software: A Guide for Insurers

Is Your Insurance Software Keeping Up?

ISO has been architecting insurance policy programs for decades. Property and casualty insurers are highly dependent on the ISO rating information to keep their products consistent with market trends as well as to launch new products that meet regulatory compliance. All is well and good, but here is the hitch. ISO initially published the rating content in PDF format and manually analyzing and processing each circular could take weeks. ISO pushes almost 75 circulars each week, so the magnitude of manual analysis is an impossible task. This meant that insurance carriers were often at least 2 years behind in adopting non-regulatory updates and this was impacting productivity. Standardization in the ISO formats helped make technology an effective contributing partner in maintaining these forms.

1. Automation using ISO EERC

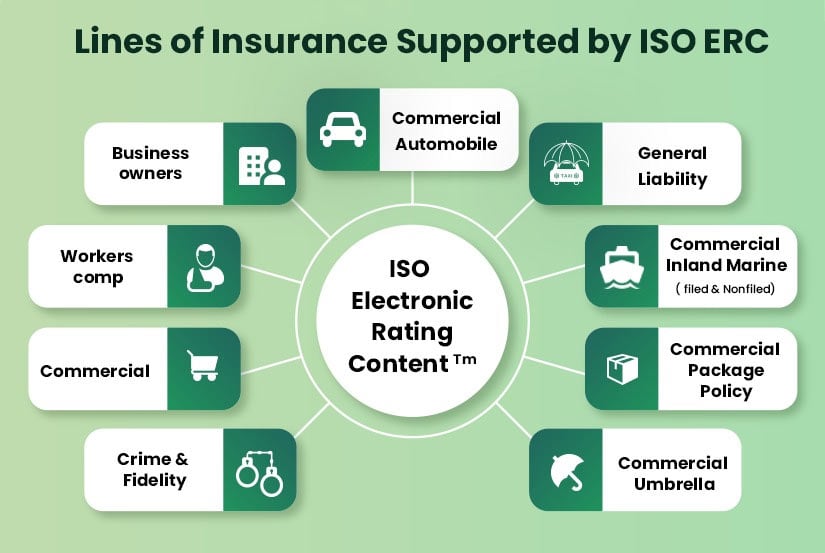

A few years ago ISO came out with a solution through the ISO Electronic Rating Content™ (ERC) and the onus to keep up to date was with the Insurance carriers. The full benefits of ISO ERC for insurers are only when they have appropriate companion technology.

When insurance carriers integrate modern rating software into their system, the process can be fully automated and present insurers with visual data that they can decide whether to adopt or not. If it is a yea, the system can be automatically updated with only the approved circulars and there will be corresponding updations in the rates, rules, and forms.

The insurer software systems should optimally have rules to automatically act upon the rating data for premium calculations, forms attachment logic, statistical code assignments, and validation messages. The Insurer can then apply company-specific deviations, as required, over the ISO base rates.

Having built-in access to relevant ACORD and ISO Forms, including certs, binders, and apps for all states, will improve efficiency. Further, new systems can electronically sign standard and custom forms through emails. A powerful Certificate Holder Database that provides the power to fill one cert and send it to hundreds of holders, along with Cert Holder Report can help you have a virtually paperless insurance company.

While insurance carriers will sooner or later move to work with ISO electronically, right now, insurer policy administration systems are not architected for ISO ERC and cost is a deterrent to retrofit platforms for this technology.

2. Industry Content Management Systems

While manual analysis and integration of bureau updates are still the norm, many insurance solution providers bring to one place all custom and pre-built bureau content from ISO and AAIS. Such a workflow tool makes coordination much easier and provides insurers with a better capability to develop new forms, maintain previous deviations, and issue new policies quicker and more accurately.

SimpleINSPIRE developed by SImpleSolve provides a powerful platform for insurance lifecycle management that helps develop insurance products in a single environment along with the ability to integrate with third-party services. SimpleSolve is a Technology and Software Services Partner with AAIS.

Topics: Workflow Management

.jpg)