Why Technology-Driven Business Models in Insurance Are a 'Must Have'

‘You can’t stop the waves but you can learn to surf” is a truth that insurance carriers are coming to terms with in the face of the waves of innovation that are surging in the industry. Business history is a reminder that even market leaders like Kodak or Nokia (the first to create a cellular network) are now forgotten because they failed to innovate. This is why insurers must use emerging technology to propel them forward. It is after all what businesses do - finding opportunity. Insurers will need to pivot from initially moving to the cloud to now leveraging its benefits through technological upgrades that support enhanced product positioning.

Innovation: The new imperative for sustainable growth

In the American insurance industry, technology-driven business models have become a crucial factor for sustainable growth. Rather than being considered a luxury or optional, they are now viewed as a necessity. The rapid advancement of technology has transformed various aspects of the insurance sector, including customer interactions, risk assessment, underwriting processes, claims management, and overall operational efficiency.

Here are some examples that illustrate the transformation in the insurance industry before and after the adoption of technology-driven business models:

1. Customer Experience

Before: Customers had to visit insurance offices or speak with agents over the phone to get quotes or purchase policies, resulting in time-consuming and often cumbersome processes.

After: Insurers now offer online portals and mobile apps that allow customers to obtain instant quotes, compare options, and purchase policies at their convenience. They can also access their policy information, make changes, and file claims online, providing a seamless and user-friendly experience.

2. Underwriting Process

Before:Underwriting involved manual evaluation of extensive paperwork and data, leading to slower processing times and potential errors.

After: With technology-driven models, insurers leverage data analytics and AI algorithms to automate and streamline the underwriting process. This enables faster and more accurate risk assessment, resulting in quicker policy approvals and improved pricing accuracy.

3. Claims Management

Before: Claims handling often required customers to fill out lengthy forms and submit physical documents, leading to delays and increased administrative burden.

After: Insurers now employ digital platforms and automation tools for claims management. Customers can file claims online, submit supporting documents electronically, and track the progress of their claims in real time. Automated workflows help streamline the process, leading to faster claim settlements and reduced paperwork.

Also Read: Digitally Transforming the Claims Process by Going Beyond the Traditional

4. Insurance Fraud Detection

Before: Detecting insurance fraud relied heavily on manual investigations and subjective assessments, making it challenging to identify fraudulent activities promptly.

After: Technology-driven models utilize advanced analytics and machine learning algorithms to analyze data patterns and identify potential fraud. Real-time monitoring and automated fraud detection algorithms enable insurers to flag suspicious claims and take appropriate actions, reducing losses due to fraud.

5. Data-Driven Decision Making

With the help of advanced analytics and artificial intelligence (AI), insurers can leverage vast amounts of data to gain valuable insights. This enables them to make data-driven decisions, develop innovative products, and improve risk assessment and pricing accuracy. Data is also improving insurance customer experience. For instance, SimpleSolve’s SimpleINSPIRE insurance platform’s seamlessly integrated Insurtech Ecosystem powers customer insights and makes data driven business decisions.

Here are some practical implementations:

Before in Risk Assessment: Insurers relied heavily on historical claims data and actuarial models for risk assessment, which had limitations in capturing real-time and individualized risk factors.

After: With technology innovation, insurers can now leverage advanced analytics and machine learning algorithms to analyze vast amounts of data in real time. They can incorporate telematics data from sensors installed in vehicles, IoT devices, and other sources to assess risk more accurately. For example, usage-based insurance (UBI) programs utilize telematics data to assess driving behavior and personalize premiums based on actual risk profiles.

Also…

Before (generalized customer experiences): Insurers had limited insights into customer needs and preferences, resulting in a generalized customer experience.

After (more data improves customer personalization): Through data-driven decision making, insurers can gain a deeper understanding of customer behavior, preferences, and pain points. This insight helps in designing personalized and tailored experiences for customers. For example, insurers can utilize customer data to provide proactive and personalized recommendations, offer targeted discounts, and improve claims processes to enhance customer satisfaction.

6. Operational Efficiency

Before: Insurance companies relied heavily on paper-based processes, leading to time-consuming administrative tasks, redundant data entry, and increased operational costs.

After: With technology-driven models, insurers digitize and automate various operations. This includes document management, policy administration, and communication with customers. Automation reduces manual efforts, minimizes errors, and improves overall operational efficiency, leading to cost savings and streamlined processes.

7. Innovation and Product Development

Before: Introducing new insurance products and services involved lengthy development cycles and traditional distribution channels, limiting innovation.

After: Technology-driven models facilitate agile product development and experimentation. Insurers can analyze market trends and customer preferences through data analytics, enabling them to launch innovative products tailored to specific customer needs. Moreover, digital distribution channels, such as online aggregators and direct-to-consumer platforms, offer new avenues for reaching customers and expanding market reach.

Usage-based insurance (UBI) in America first started to gain traction in the early 2000s. The emergence of UBI was made possible due to several key factors

- Advancements in Telematics Technology - Telematics technology combines telecommunications and information processing, playing a crucial role in enabling UBI. With the development of GPS (Global Positioning System) and onboard diagnostic devices, insurers could capture and analyze real-time data related to driving behavior and vehicle usage.

- Telematics devices could collect data on factors such as mileage, speed, acceleration, braking patterns, and even location information, allowing insurers to personalize premiums based on actual driving habits.

- The technology availability dovetailed with the consumer demand for personalized and fair pricing.

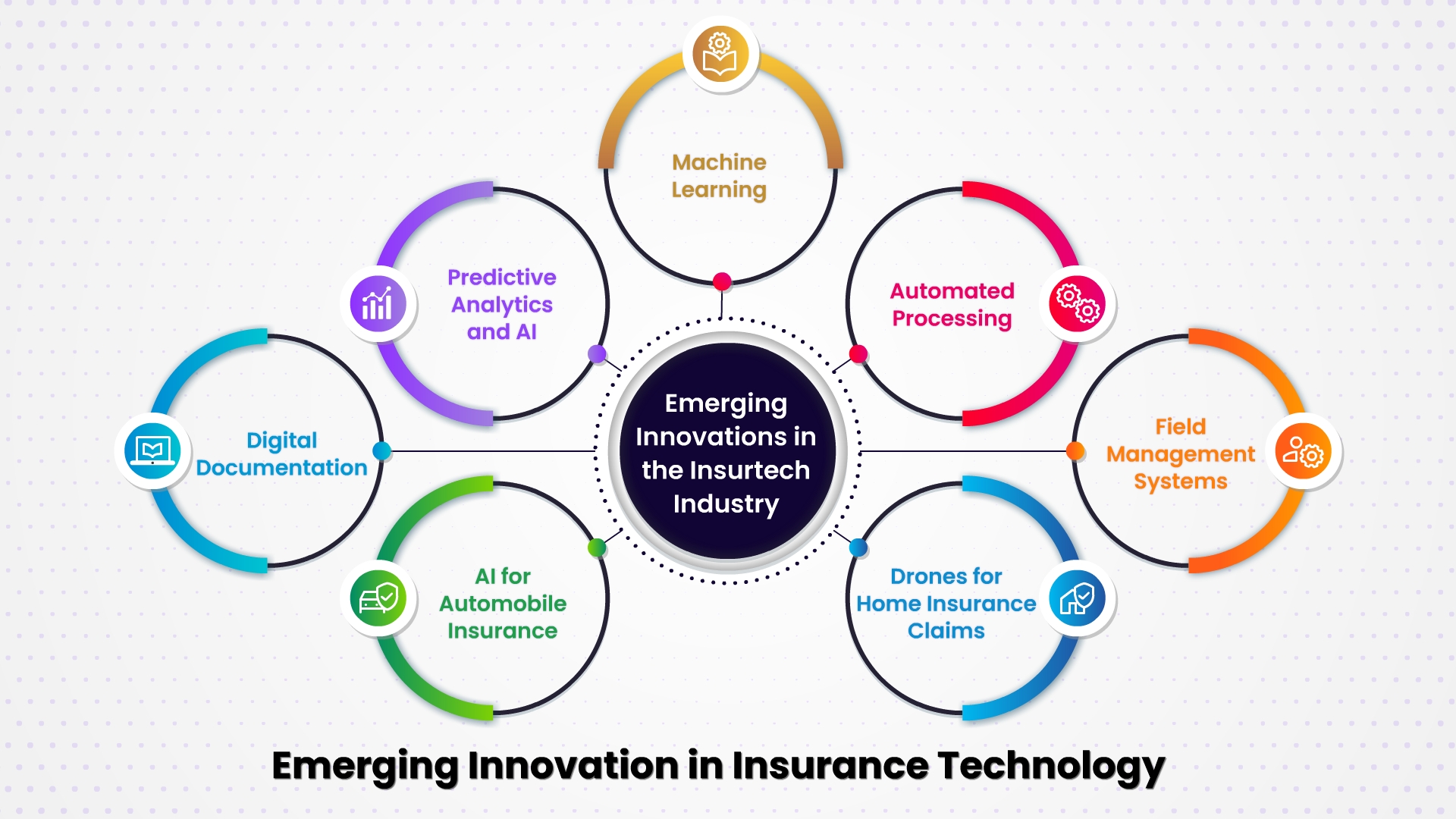

These examples demonstrate how technology-driven business models have revolutionized various aspects of the insurance industry, enhancing customer experiences, improving operational efficiency, and fostering innovation.

If your current Core Platform is not escalating business performance, it is time to talk to our senior team for a demo of SimpleInspire Core insurance Platform and the innovation it delivers for your business.

Topics: Digital Transformation