The Effect of Supply Chain Disruptions on P&C Insurance Carriers

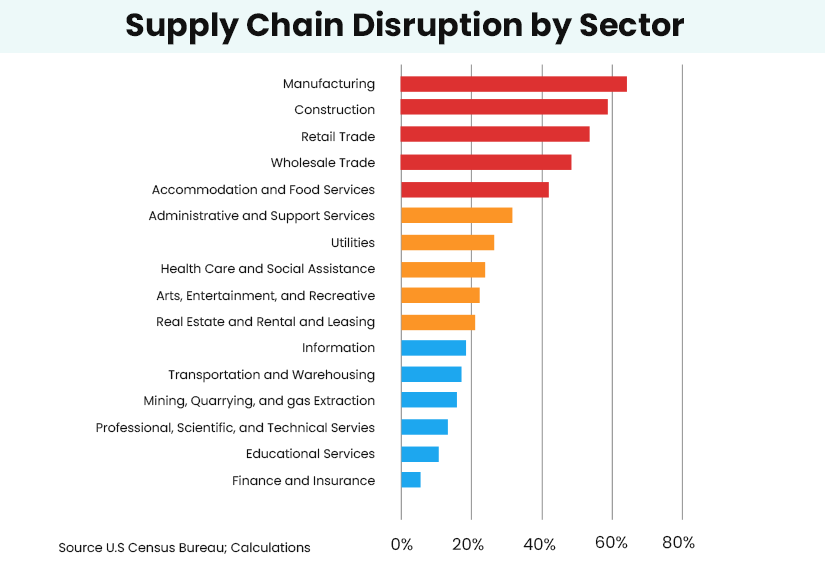

In 2023, the spotlight has been on the escalating tensions between the United States and China. The trade dynamics between these nations are wielding substantial influence on the global trade landscape. Companies engaged in business or operations in the Israel-Hamas conflict zone are witnessing shifts in their financial prospects. The ongoing turmoil is affecting various aspects, ranging from advertising revenue and tourism to supply chain dynamics. The continuing conflict in Ukraine saw a domino effect on supply chains around the world as supplies were hit, businesses closed their factories and inflation rose.

All of this comes after a tough two years of the Covid pandemic, the Suez Canal blockage, and the blackout from Winter Storm URI in 2021. In short, the supply chain is continuously being impacted by political and natural calamities. Other factors also cause supply chain disruptions, such as a shortage of skilled workers but they might not grab headlines. Seemingly, there is nothing as volatile as the supply chain and P&C insurance is always in risk mitigation mode.

The domino effect of disruption on supply chain risk insurance

An Allianz 2022 Global Risk Barometer report indicated that 45% of companies have suffered a financial impact from recent supply chain issues. Supply chain risks are always interconnected and organizations bear the brunt on many levels. For example, a large multinational corporation cannot replenish the exhausted supply of a key product because of port delays. This leads to a business interruption risk. This in turn causes reputational loss because the customer is depending on the cargo reaching in time. This is reflected in financial risk with a loss in sales revenue. This is just one more instance of the domino effect where supply chain risks can cause a cascading impact.

U.S. business leaders ranked business interruption including supply chain disruption as the No. 1 supply chain risk for stateside companies in 2022

Globalization has increased the inherent risks in extended supply chains. Manufacturers and their insurers grapple with limited visibility and control over partners, especially beyond their primary suppliers and customers the "tier one." A recent survey highlights that merely 2% of companies have insight into their supply base beyond the second tier. Businesses are analyzing all points of their supply chain and putting in place steps to mitigate risks where problems can occur. Often, the supply chain might include countries with less developed infrastructure where risk management and asset protection might not be at the level of more mature markets. Some companies are leveraging artificial intelligence technology and predictive analytics to better understand these real-time risks.

This heightened risk underscores the significance of supply chain insurance, a crucial safety net providing businesses with financial protection against disruptions. However, these disruptions directly impact Property and Casualty (P&C) insurance carriers, leading to an increased claims volume and underwriting challenges. It prompts insurers to reassess and adapt their strategies to effectively mitigate these evolving risks.

This might interest you: Why Insurance Ecosystems Have Taken on New Urgency

Can P&C insurance help fill the gaps?

To minimize their financial loss most businesses turn to their insurance programs. Insurance cannot take away the risk of supply chain disruptions but it does play a major role in contributing to a business's ability to recover from interruptions. Organizations expect their insurance companies to be thought partners and provide both intellectual capital as well as specialized coverage.

Specialized supply chain insurance and contingent business interruption insurance coverage can provide a line of defense against property damage and loss of profits from business interruption. Supply chain insurance covers risks such as labor strikes, production issues, and political or civil unrest. While business interruption insurance is normally limited to damage to property such as in a fire or flood. Then there are other insurance coverages such as trade credit, product recall, cyber insurance, and cargo insurance. However, no two supply chains are the same, which makes the advice of a knowledgeable broker invaluable as well as closely reviewing any policy language to make sure the coverage fits the company’s needs.

Also read: Modern Insurance Core Platforms - Smarter, Faster, Better?

The insurer’s contribution goes beyond policy coverage

The supply chain looks toward insurers for more than just policies and insurers are responding with a bundle of services like risk analysis, benchmarking, and mitigation advice. To be able to do this, insurers are in turn looking at technology to drive insights. Supply chain insurtech solutions are integrating tools that use big data to manage disruptions in the supply chain better.

Insurtech through data-driven risk assessments and personalized engineering advice, enhances supply chain resilience. Advanced analytics and real-time data enable a more accurate evaluation of potential disruptions. Personalized recommendations cater to the unique needs of client-supplier locations, aligning risk mitigation strategies with the supply chain's distinctive characteristics. The Supply Chain Impact Analysis delves deep into a client's business model, finances, and engineering risks, providing nuanced insights into financial exposure at any point in the supply chain. This comprehensive approach empowers businesses with actionable insights for proactive risk management.

Insurers are also moving over to an automated, secure claims ecosystem that helps in faster and more cost-effective handling of claims. Risk engineering is becoming much more flexible as well. Many P&C carriers do not require their risk engineers to travel the world to make a physical inspection, instead, there is greater utilization of virtual inspections or in-country resources to better support their clients. It does not stop here. Property and casualty insurance carriers have developed sophisticated catastrophe modeling capabilities and this expertise is extended to their clients to evaluate the natural peril risk both in the supply chain as well as on supplier premises. Early warning systems EWS can come to the aid of companies to anticipate supply chain disruption, predict their potential impact, and quickly communicate ways to solve the problem. For example, if an update is received that a supplier might fail to supply then the database recommendation engine must quickly identify alternate suppliers to move the order to.

Trucks, ships, and air cargo are the most vulnerable cogs in the supply chain. This is borne out by the fact that 84% of incidents (in the supply chain) involve these transportation modes. The three most likely causes of loss or damage are theft, rough handling, and environmental conditions. A revealing insight is that road transport cargo in the U.S. accounts for over 40% of these incidents, with 2.2 reported thefts each day. The average value of each cargo theft is $232,924.5 and that adds up to a ginormous loss from cargo crime.

Road transport cargo in the U.S. accounts for 2.2 reported thefts each day. The average value of each cargo theft is $232,924.5.

The supply chain tries to counter criminal attacks by using intelligence systems to identify high-risk areas and installing telematics devices on trucks and trailers. Technology though is being employed by criminals as well - they are using it to hack into supply chains and gain access to targets and not leave a trail for investigative follow-up. The International Union of Marine Insurance is working with the shipping and transport industry to put in place several measures that will reduce cargo theft. The report recommends the development of cargo theft information-sharing programs. This is in direct response to the fact that cargo crime has a low rate of detection and imposed punishments are not deterrents to potential profits from cargo theft.

Technology is therefore the key for insurers in building positive relationships. Insurers who look after their supply chain partners will gain a competitive advantage when it comes to their value-driven customer base.

Topics: Risk Management