Automated Insurance Underwriting: Why 77% of Insurers are Automating Quotes

A recent survey by Conning reveals that 77% of insurers are now integrating AI into their value chain, a substantial increase from the 61% reported in 2023. This is a 16% increase in the space of a year and underscores why American insurance companies, irrespective of size, cannot remain competitive without including AI - particularly in automated insurance underwriting - to enhance efficiency and innovation within the industry.

The Conning Study gathered insights from C-suite executives responsible for approving new technologies and highlights a significant trend: 67% of companies are currently piloting large language models (LLMs). These sophisticated AI systems, capable of understanding and generating natural language, are poised to revolutionize a wide range of tasks in the insurance sector. Insurtech platforms such as SimpleINSPIRE are building agile underwriting applications that can be easily modified to fit underwriting rules and conditions in different markets and individual insurance companies.

Automated Insurance Underwriting vs. Manual Underwriting

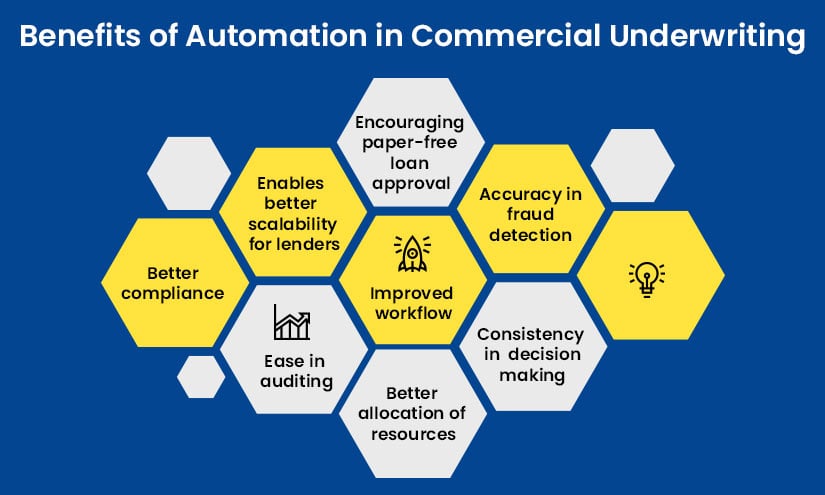

Carriers are increasingly revamping their product portfolio strategies, improving pricing sophistication, and focusing on customer experience. At the core of this industry-wide transformation is the underwriting function. Market pressures demand a modernized underwriting process, making automated insurance underwriting a key part of personalizing and speeding up the quoting process.

Automated insurance underwriting efficiently calculates the risk a customer poses. Manual underwriting requires sifting through countless documents to assess the risk of insuring an applicant, resulting in a process that can take weeks. This traditional approach is time-consuming and prone to human error, leading to potentially incorrect risk assessments.

This does not mean that manual underwriting has no part in a modernized underwriting strategy. Manual underwriting is necessary for unique cases or high-value premiums. Experienced underwriters should focus on these rather than have resources drained in high volume but standard policies. In these instances, algorithms can deliver more efficient automated consistent underwriting decisions.

New insights on this topic: Algorithmic Underwriting Isn't New, but the Tech Behind It Is

Example of Automated Consistent Underwriting Decisions in P&C Insurance

In property and casualty (P&C) insurance, automated underwriting systems apply standardized criteria uniformly to all applications, ensuring consistent decisions. For example in property insurance, automated underwriting systems can analyze data such as property location, building materials, and local crime rates to assess risk. If the criteria specify that homes within certain flood zones require a higher premium, the automated system applies this rating uniformly to all relevant properties. This ensures automated consistent underwriting decisions, eliminating variability and improving accuracy, fairness, and efficiency, leading to better risk management and customer satisfaction.

Underwriting plays a crucial role in one of the first customer touchpoints and can greatly influence customer retention and drop-off rates., while this is always known, it is being factored in now as the starting point of personalizing the customer journey.

Achieving underwriting excellence in today’s customer-centric world will mean reimagining risk selection, leveraging advanced applications of AI and ML, deploying modern analytics including third-party data and redesigning customer onboarding.

Improved data quality along with AI is opening up new underwriting opportunities

The unprecedented access to customer data that underwriters now have means that traditional forms of risk selection might no longer be valid. Today, insurance has access to a wealth of data that can paint a more holistic, personalized picture of the individual for more accurate risk selection.

Also Read: AI for Insurance - Everything You Need to Know

AI & ML can reduce processing times

New sources of information are churning out higher volumes of data. Raw data needs to be cleansed before it can provide insights. However, data quality assurance when dealing with this amount of data can only be accurately performed by advanced AI and ML applications. This is also crucial because applications can perform data extraction in a fraction of the time it would take for humans to perform the same task.

AI and ML applications can perform data extraction in a fraction of the time it would take for humans to perform the same task.

Today, when customers can get quotes from online insurance providers in a matter of seconds, maintaining fast processing times in underwriting can be a key differentiator. Automated underwriting significantly speeds up quoting by utilizing generative AI and large language models. These technologies combine structured data from various databases with unstructured data like images, videos, and documents. This integration enhances internal knowledge management, streamlining information processing and underwriting reviews, resulting in quicker and more cost-effective quote generation.

Large commercial brokers also prefer to work with providers who consistently maintain high levels of underwriter productivity. However, bringing on more underwriters to achieve this is not sustainable for an insurance provider. SimpleINSPIRE, for instance, uses Machine Learning and AI to automate several manual processes such as data extraction from PDFs and printed documents and assessment of data quality. Automated underwriting reduces the time taken to process submissions and perform data quality assurance checks, helping underwriters focus on the more strategic aspects of their roles, such as managing broker relationships.

For customers, automated underwriting means shorter waiting times, higher satisfaction, and more accurate processing.

Automate insurance submission triage of incoming requests

Automated insurance submission triaging takes care of filtering applications for you, so underwriters can focus on the more important tasks that need their expertise.

A significant portion of incoming submissions are straightforward and can be easily handled through automated workflows. However, in most cases, these submissions are still sent to underwriters who have to manually process them. Apart from the increased turnaround time, certain risk classes might need a differentiated process and elite underwriters specialized for this might be busy with routine tasks rather than high-value submissions. Such flexibility is absent from current underwriting workstreams.

A more efficient approach for underwriting in insurance would be to use intelligent rules to triage incoming requests based on their complexities, automate routine queries, and route only complex and high-value submissions to underwriters. A prioritized work queue will improve the premium yield per underwriter. Since submissions are processed faster, your customer satisfaction rates improve and your business can gain a loyal customer base.

Auto-assignment rules can also be applied according to industry categories. P&C insurers, for example, largely see Small and Medium businesses as homogenous entities. Despite some variations in their risk profiles, coverage for small and medium enterprises is largely standardized. These applications can largely be automated to reduce processing times. Mid-market companies are more complex than SMEs but are not as varied as large companies, so some stages can still be automated. Large enterprises have the highest range of variability and therefore, underwriters can use the time saved through automation to spend more time on these requests.

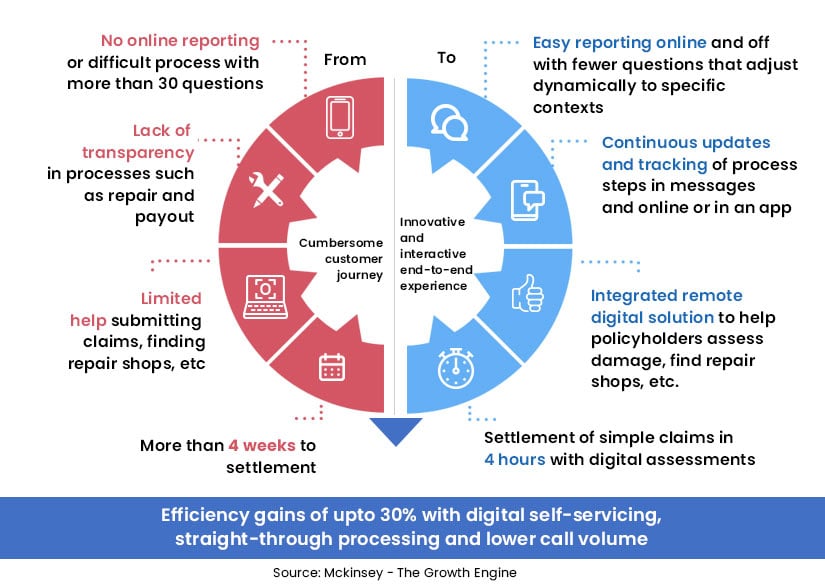

Increase transparency through self-reporting

Improving the quality of your customer base also extends to building an onboarding process that is customer-centric. Most insurance carriers today have application processes that are designed to collect information that underwriters need rather than to provide customers with a hassle-free experience.

A comprehensive underwriting modernization strategy should balance broad enterprise solutions with targeted initiatives for specific lines of business. It's crucial to scrutinize the latter to avoid unnecessary investments in processes that technology can streamline.

Transforming an organization is not an easy decision but using technology and digital as innovators has a value-promise that is hard to ignore. The first step is to transform the underwriting function. It is after all the gatekeeper to a brand promise that customers will experience with each interaction in their journey with the insurance brand they choose.

For further insights on the SimpleINSPIRE platform's innovative strategies to develop, deploy, and scale your P&C insurance products, reach out to us today or call us at 609-452-2323 for a demo.

Topics: Intelligent Automation