10 Ways Insurers Win with SimpleINSPIRE's Core Insurance Platform

SimpleINSPIRE Insurance Platform and Tara, your AI Assistant are redefining insurance operations. We unravel the seamless fusion of technology and innovation, a fusion that accelerates your journey toward operational excellence and revenue augmentation. Embark on a transformative expedition that promises not only insights but actionable strategies to reshape your insurer's landscape. Welcome to a future where the potential of SimpleINSPIRE insurance software and the intelligence of Tara shape your insurer's success story.

The advanced capabilities of SimpleINSPIRE that set it apart

1. User Efficiency - Reduces Average Handling Time

SimpleINSPIRE's streamlined user interface and its lightning-fast navigation tools empower insurance professionals to access critical information in record time. SimpleINSPIRE's Policy Management system boasts a visionary architecture and relies on disruptive technologies to enhance user efficiency. The digital-first imperatives of today's insurance landscape make the SimpleINSPIRE platform ideally situated to make businesses take charge, driving transformative change rather than reacting to it.

2. Automation of Manual Work Processes

Automation is a key aspect of the SimpleINSPIRE system and it can be utilized to the point where manual intervention can be eliminated in the policy life cycle. This adaptability enables the creation of high-performance insurance models, with options to fully automate policy processing or employ a hybrid approach based on the Line of Business (LOB). Whether ingesting quotes, utilizing AI/ML, or managing renewals, each step seamlessly integrates automation or manual processing as needed. This is why SimpleINSPIRE's automation prowess significantly reduces manual efforts. Automatic renewals and real-time claims coverage verification are known to boost customer retention.

3. Email Integration - Send Emails with One Click

Experience the power of integrated email capabilities that enable agents to send tailored messages with a single click. Clients respond faster to personalized communications. This often leads to improved engagement, potentially resulting in increased policy renewals and new sales.

Also Read: New Policy Management Software: The guide to getting it right

4. Powerful Search Capabilities

SimpleINSPIRE insurance software’s cutting-edge search functionality empowers employees to locate critical data 3 times faster. An enhanced search function contributes to more focused and productive work, potentially freeing up time for revenue-generating activities.

5. Voice-to-Text (Dictation)

Agents and adjusters have to meet policy and claim quotas while often spending up to 50% of their day on report and documentation typing. Voice technology emerges as a transformative solution. This innovative approach addresses the challenges faced by insurance professionals and opens up new avenues for actively engaging with clients.

6. Full Integration to Avoid Duplicate Data Entry

The seamless integration across modules aims to eliminate redundant data entry and errors. The efficiency surge can often lead to more than a 90% reduction in duplication errors This integration can contribute to improved accuracy and efficiency, potentially avoiding losses associated with data discrepancies.

7. Client-Centric Customer Management Features

The extensive automation integrated into the SimpleINSPIRE platform directly translates to heightened customer satisfaction. Picture a scenario where an insured effortlessly quotes and purchases a policy through a direct sell portal or agent, and from that point onward, there's no need for human involvement throughout the policy's life, including renewals, unless a business rule exception arises

The platform includes a self-service Customer portal enabling users to reprint policy forms, invoices, view accounts, make payments, and check the status of claims. This seamless, hands-off approach not only simplifies the customer experience but also ensures swift and efficient policy management, contributing significantly to overall satisfaction.

8. Designed for the Cloud at an Affordable Price

Harness the scalability of SimpleINSPIRE's cloud-based architecture that adapts to your business needs. The platform’s high-performance processing capability results from a smart database architecture, efficient transaction processing models, and the utilization of advanced technologies such as cloud processing, elastic search, server caching, and browser caching. These elements, coupled with failover backup options, guarantee an exceptionally high system uptime. As a cloud-based solution, you also enjoy the flexibility to leverage various cloud infrastructure scaling options for optimal performance and scalability.

SimpleINSPIRE empowers you to scale efficiently, aligning with your evolving needs and ensuring optimal performance.

9. Unmatched Scalability

SimpleINSPIRE's insurance platform has a proven track record that speaks volumes - over 15,000 quotes processed daily with minimal performance degradation. Your business growth has no limits, as SimpleINSPIRE seamlessly manages your transaction volumes.

On the security aspect, SimpleSolve adheres to SOC2 Type II Compliance. We also conduct regular Web Application Security Audits, specifically Vulnerability and Penetration Tests (VAPT), to mitigate potential risks.

Also Read: Authorization and Authentication Process: 5 Ways to Fix Security Gaps

10. Data-Driven Insights

Tap into the integrated Insurtech Ecosystem within SimpleINSPIRE, unlocking precious customer insights. Empower your business decisions through data-driven strategies that align with your growth objectives.

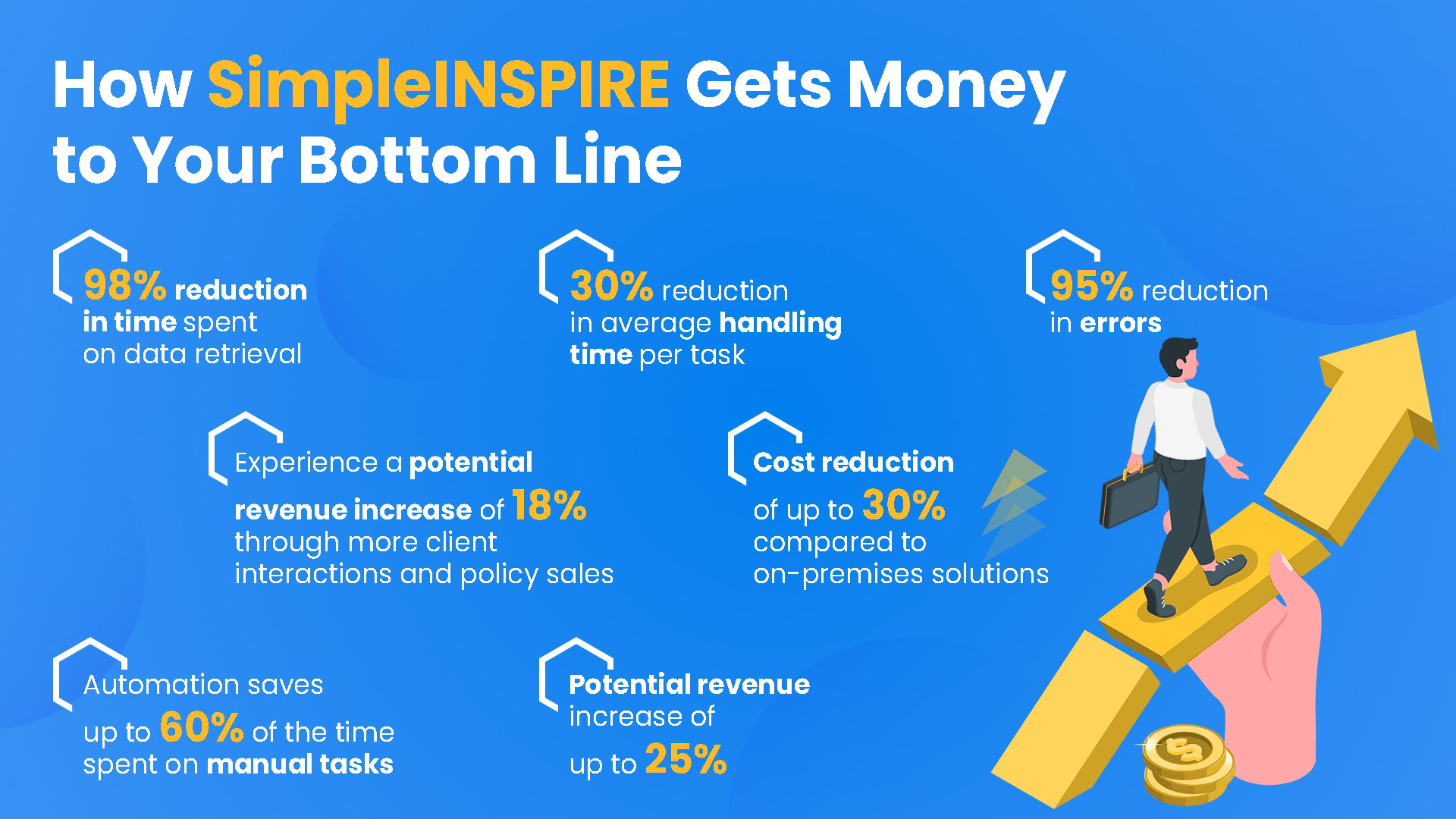

With SimpleINSPIRE's feature-rich platform and these remarkable results, insurers can truly wow their stakeholders by boosting operational efficiency, customer satisfaction, and ultimately, their revenue streams. If these proven data-backed features for revenue growth are not enough, there is even more to the SimpleINSPIRE insurance software platform.

Unveil the Power of Tara, Your AI Assistant

Imagine an assistant who knows you, knows your system and anticipates your needs. Tara seamlessly navigates the intricacies of SimpleINSPIRE's insurance software, delivering context-based interactions that bridge the gap between users and technology. With Tara, routine tasks become automated, data becomes insightful, and customer interactions become effortlessly personalized.

Meet Tara, your intelligent AI assistant bot, ready to revolutionize your workflow:

-

Contextual Understanding and Integration: Tara, your smart BOT, seamlessly integrates with SimpleINSPIRE, holding a deep understanding of your location within the system and your identity. As an AI-driven virtual assistant, Tara adapts to your needs, providing context-based interactions that enhance both user engagement and system functionality. Additionally, Tara can trigger external Insurtech services, effortlessly integrating their outcomes within SimpleINSPIRE for comprehensive insights.

-

Intelligent Decision Support: Leverage Tara's prowess in external data integration and historical data analysis for advanced decision support. Tara even shines during New Business (NB) quoting, identifying upsell opportunities that augment your revenue potential.

-

Natural Language Interaction: With the power of natural language processing (NLP), Tara can be empowered to provide user training and answer common business queries, serving as a valuable self-service resource for application users.

-

Omni Channel Quote Ingestion: Experience the future with Tara's omni-channel quote ingestion. Seamlessly boost quote volumes across channels, ensuring an unparalleled experience for both customers and producers. By automating routine tasks, your human resources are unleashed for impactful endeavors.

-

Enhanced Workflow Efficiency: Embrace a new era of efficiency with user-centric features, automation capabilities, and a streamlined workflow function. Reduce or eliminate manual tasks during policy lifecycle management, allowing your team to focus on high-value activities.

Tara, coupled with SimpleINSPIRE's unmatched capabilities, propels your insurance operations to new heights. Engage with AI-driven precision, leverage an integrated ecosystem, and experience high performance that anticipates your business's future needs.

SimpleSolve's PEAR Delivery Methodology

Introducing SimpleSolve's PEAR (Partnership, Expertise, Accountability, Results) Software Delivery Methodology, an unwavering commitment to your carrier's triumph. With us, you gain more than just a solution; you gain a full-service vendor partner dedicated to enhancing your success at every turn.

Partnership and Accountability

We don't just deliver software; we forge partnerships. At the forefront of SimpleSolve's PEAR Methodology is our commitment to your bottom line We shoulder the responsibility for your carrier's success, collaborating with you at every step. The scope is meticulously defined through our robust Discovery process, leaving no room for surprises. Our partnership is fortified by fixed-price contracts, ensuring transparency and accountability.

Expertise and Precision

Screens aren't just built; they're perfected. Before a single line of code is written, screens are meticulously prototyped to guarantee user satisfaction. Our experts leverage their proficiency to create intuitive interfaces that align with your business needs. Rigorous testing is an inherent part of our software delivery process, ensuring a flawless transition from development to User Acceptance Testing (UAT) and ultimately, seamless production implementation. This is why we brand SimpleINSPIRE as an insurance platform developed for insurance carriers by insurance experts.

Results and Value

We do the heavy lifting so you can focus on your core business. With SimpleSolve's PEAR Methodology, we enable you to direct your efforts toward growth, innovation, and value creation. By alleviating the operational burden, we free up your resources for strategic initiatives that drive revenue and elevate your market standing.

Implementation Track Record

Our track record speaks volumes of our software delivery methodology. With countless successful implementations, our pride stems from your achievements. The synergy between SimpleSolve's PEAR Methodology and your carrier's goals, results in seamless, on-time, and on-budget projects. Our history of consistent delivery sets the foundation for your continued success.

Comprehensive Annual Support

We're invested in your long-term prosperity. SimpleSolve's PEAR Methodology extends beyond implementation; it includes unwavering annual support. We take ownership of the entire ecosystem, ensuring its health and vitality. Unlike others, we do not nickel-and-dime our customers; we stand by our commitment to excellence. Any defects that arise are resolved at our cost, upholding the integrity of your operations.

Experience the synergy of SimpleSolve's PEAR Delivery Methodology and your carrier's vision. Elevate your success, fortify your partnerships, and embark on a journey where accountability, expertise, and results amplify your impact in the insurance landscape. Get a demo of SimpleINSPIRE today!