SimpleINSPIRE: Improving Policy Management Lifecycle

Policy administration systems (PAS) are the backbone of every insurer’s core processing system, be they giant multi-line insurers or niche specialist carriers. As the insurance industry is evolving to keep up with digital transformative technologies, policy management systems must also integrate a more flexible and adaptable architecture that can quickly respond to changes in regulatory compliance, market dynamics, as well as customer preferences.

Historically, policy administration software systems have been inflexible and non-customizable but systems like SimpleINSPIRE are at the forefront of utilizing microservices to be endlessly scalable. The added advantage is that it also taps into hidden value from internal operations by automating processes.

Cloud-based and APi-centric microservices architecture

The SimpleINSPIRE platform has refined policy management systems by utilizing a fully modern microservices architecture. Each function of the policy lifecycle management has its own individual API for rating, quoting, binding, issuing, endorsements, and renewals.

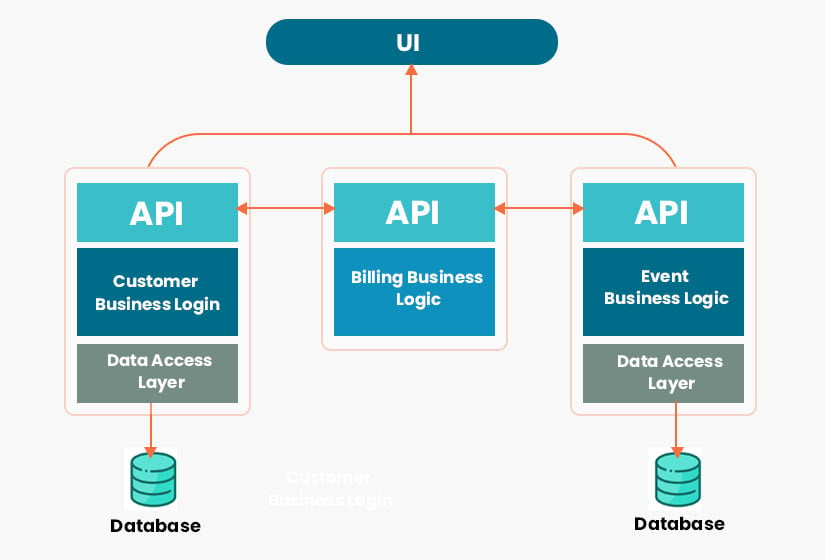

Open APIs and Microservices are terms often interchangeably used. An API, though, is only the communication protocol that can exist within a microservice. It is the contract that guides how microservices can interact with each other.

A microservices designed architecture separates a previously monolithic application into small, self-contained services. The advantage of this is that each microservice can be built differently based on its individual needs and can even have its own tech stack. As illustrated here, not every microservice needs a database.

SimpleINSPIRE uses multiple microservices and their corresponding APIs

-

Document Generation APIs

-

Submission and Quote Life Cycle APIs

-

Billing Life Cycle APIs

-

Policy Life Cycle APIs

-

Discrete Services APIs ( any service can be added or dropped without affecting others)

-

Third-party integrations (eg. Integrates with IoTs and UBI programs)

Each service in our microservices architecture uses a common messaging framework called RESTful APIS. This makes communication easier without additional integration layers or data conversion transactions. Each service is also discrete i.e. it implements a specific business function. This is a lightweight architecture that optimizes the cloud infrastructure and allows any service to be replaced or upgraded without affecting the other components.

The benefit of such an architecture is that overhauling the entire system is not essential. Insurance carriers can continue to use their existing administration systems and selectively replace time-consuming and costly functions.

Rating Engines and Policy Management

The P&C insurance sector is looking at new, complex dynamic rating models due to the exponential growth and availability of data. A rating engine developed as a microservice with an independent callable engine can be the source of rating across multiple platforms and lines of business. Rates and their factors can be revised by effective dates by product policy/ By state / By NB vs Renewal.

The SImpleINSPIRE system also generates all applicable policy forms, including state endorsement and company-based forms, and employs a one-page quick quote and validation flow. Both underwriters and agents use the exact same application. The policy management system can also extend, orchestrate, and collaborate with external services such as

-

Replacement cost evaluators

-

Risk assessment services

-

Insurance Credit Scores

-

MVR Reports

-

CLUE

-

eSignatures for policy documents

-

Payment Gateways for online payments

-

CNPP processing

The policy administration software system comes with a Policyholder Self-service Portal that serves as an intermediary between customers and agents and underwriters. The built-in functionality verifies coverage and prints policy documents as well as enables online payments.

Automation for efficiency

Automating basic workflows can lead to a 68% increase in productivity.

Insurance automation software can streamline day-to-day processes. Automation covers a wide range of technologies but the most popular ones used in insurance processes are Robotic Process Automation (RPA) and Intelligent Automation (IA).

SImpleINSPIRE uses Machine Learning and AI to minimize manual intervention by automating new business policies, auto-renewals, auto-cancellations by due-date or equity-date based, and barcoded batch printing of documents. RPA bots can automate the most mundane and repetitive tasks as well as automate data collection from internal and external sources to reduce the time taken in underwriting.

By automating internal processes, participants across departments are seeing the same information at any given time. The solution also provides the ability to deep dive and analyze key business performance indicators through customized BI Dashboards.

Also Read: The Crucial Role of Business Culture in Software Vendor Partnerships

Safeguarding the API environment

The application code adheres to the standards set in web security and application security and is periodically VAPT audited. Vulnerability Assessment and Penetration Testing (VAPT) can identify and address cybersecurity vulnerabilities. It tries to exploit the system to find if it is vulnerable to any unauthorized access or malicious activity so that gaps can be plugged.

Application security is further enhanced using OAuth Authentication (pronounced “oh-auth”). OAuth authentication is through a system of access tokens to allow unrelated servers and services (read third-party) access to their assets without actually sharing login credentials. The open-standard authorization protocol checks access tokens against an OAuth Identity Manager and give temporary access to an application. The access token expires either within minutes (if set) or at every logout. This is an industrial-strength authentication model that is used by web applications today.

In addition, there is Intra-page Encryption by which data exchange between web application pages is also encrypted (SHA-256 Cryptographic Hash Algorithm)

Key Security Features for Authentication and Authorization

-

Web Application Security Compliance

-

OAuth Identity Manager utilizes Web Tokens

-

Intra-Page Encryption

-

PII Compliance

-

Role-based Application Security

Scalability for future proof growth

Ultimately system scalability is crucial and insurance carriers want to invest in a system with confidence that it will not need to be replaced for a long time to come. SImpleINSPIRE has proven scalability to handle an ever-increasing workload and the open insurance solution enables B23 growth.

B23 systems are highly scalable because they eliminate vendor-lock-in so that they can capitalize on community innovations.

Apart from product innovations, SImpleSolve’s overall value proposition is also industry expertise (each of our key members has between 20 -40 years of insurance sector expertise both in business insights and technology.

“We have a very high and verifiable success rate in taking our customers into production in under a year” - Antony Xavier, co-founder SimpleSolve

Would you like to see our product in action? Schedule a demo today by calling 609-452-2323 or email bschwarzATsimplesolve.com or fill out the contact form here.

Topics: Policy Management

.jpg)