The Shift to Usage-Based Insurance Model From the Pandemic to Now

Just a little over a year ago, it would be safe to assume that most people spent a significant part of their day behind the wheel. The average person would have to travel each day to get to work, drop their kids at school, do a quick grocery run or even go on a weekend getaway. With the onset of the COVID-19 pandemic, much of this activity has come to a complete standstill.

The biggest change, of course, is in our daily commute to work. Most companies have moved to a remote work setup, with no plans of returning to offices any time soon. As a result, your total miles clocked last year is probably the lowest it’s been in a long time (almost 41% lower). The study by KPMG indicates that as everything opens up, the vehicle miles traveled will be 90% of pre-2020 levels. In this scenario of decreased car usage, insurance carriers need to re-evaluate older methods of calculating premiums. The best new alternative that has emerged is a Usage-Based Insurance model.

The study by KPMG indicates that as everything opens up, the vehicle miles traveled will be 90% of pre-2020 levels.

Usage-Based Insurance - a modern tool

Traditional estimations of premiums would take into account a customer's overall profile to understand how much risk they were exposed to and calculate premiums based on that. Of course, none of these risk factors would be relevant if policyholders weren’t driving their cars very often. In this scenario, an individual who was working from home and an individual who had to drive 10 miles to work every day, would have more or less the same insurance premiums if they had similar credit score, driving experience, and past records.

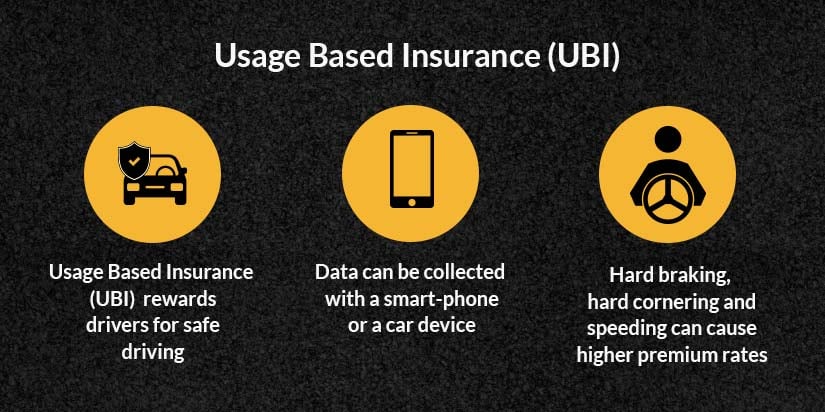

With COVID-19 and the ensuing lockdown, user’s commute patterns have shifted drastically. Usage-Based Insurance (UBI) moves away from a fixed assessment framework and instead, calculates premiums based on the number of miles driven by a user. The time frame for adjusting prices can be as short as a week, which is very useful for accurate rate evaluation at the earliest.

UBI insurance as a concept was introduced several years ago but never managed to gain a foothold. Today, because of the insights gained during the pandemic, insurers realize that a UBI insurance model could be the best solution for carriers and policyholders alike.

Usage-Based Insurance (UBI) moves away from a fixed assessment framework and instead, calculates premiums based on the number of miles driven by a user.

The use of UBI telematics system to calculate accurate premiums

When considering usage-based insurance, the most obvious question that arises is, ‘How do you calculate usage?’ Telematics has long been used to record driver behavior, usually through a device known as a black box. But advancements in smartphone technology have made the black box obsolete. In this new UBI telematics system, a smartphone app can track the number of miles covered and the speed traveled by the driver using the mobile phone’s GPS. This makes it easier to opt for a usage-based insurance scheme since it requires no extra effort to install special devices.

Ford Motor Co. is using its vehicular technology to secure agreements with insurance carriers like State Farm, Allstate, and Liberty Mutual to put drivers in control of an individualized pay-per-mile rate. Tesla and GM Motors have ventured into auto insurance fairly recently, to leverage their technology to lower premium rates.

The insurance industry as a whole has been moving towards personalization of the customer experience, and telematics is a step towards this. Using a UBI telematics system, insurance carriers can calculate highly individualized premium rates based on a person’s usage, driving skill, and distance traveled. A safe driver who has low usage will automatically be charged a lower premium since they are less likely to get into an accident and make a claim.

Also Read: Social Inflation in Insurance: Nuclear Verdicts Driving Up P&C Liability

Benefits of switching to usage-based insurance

Usage-based insurance can lead to major cost savings for policyholders and carriers alike. Premiums are calculated based on risk and usage, so a reward structure is inherent within it. Safe drivers are rewarded with low premiums, providing them with an incentive to keep driving safely. Rash drivers have to pay high premiums, which can motivate them to start driving safer. This, of course, contributes to the greater good by keeping roads safer. For carriers too, personalized estimations of premiums can lead to more accurate predictions of users who are most likely to file for claims. This helps decide on premiums precisely and increases overall profits.

Offering usage-based insurance can also be a great value proposition and help carriers gain more customers. Since UBI insurance plans tend to be cheaper than traditional policies, users will be more likely to opt for them, especially when they aren’t using their cars as frequently.

Common types of usage-based insurance plans

Within usage-based insurance, there are a number of specific types of plans that carriers can choose to provide. Broadly, these include:

- Distance-based: Users need to pay premiums directly proportional to the number of miles driven within a specific time period

- Pay how you drive: Premiums are calculated based on the skill of the driver. A driver who speeds or breaks too often will be charged a higher premium

- Pay as you go: Pay as you go is a combination of distance and skill. Drivers who cover less distance and drive safely will be charged the lowest premiums

The insurance industry has been going through many changes and the emergence of usage-based insurance is further proof of that. Today, everything is discussed in terms of before and after the pandemic because the world as we live it has changed dramatically. Even as everything goes back to normal, the pandemic has played a big role in hastening the adoption of insurance telematics, greater personalization, higher adoption of technology, and flexible plans. With UBI predicted to account for $149.22 billion in insurance sales by 2027, it’s clear that this could very well be the future of automobile insurance.

Also Read: Cracking the Usage-Based Insurance Code for Regional Carriers

While usage-based insurance (UBI) gained momentum during the pandemic, the insurance industry is now on the cusp of a new transformation. Emerging technologies are set to redefine risk assessment and customer engagement in auto insurance in America. Discover how Telematics 2.0 is taking UBI to a new level of customer experience.

Topics: Digital Transformation