Impact of Covid-19 On Insurance Budgets and Investments

Insurance is built around calculated risk, but even the most diligent of analysts cannot anticipate certain events. The Covid-19 pandemic completely reshaped ‘Business as Usual. As insurers come back to the office, they can take a pat on their back for how they have risen up to the challenge - some better than others. They were the ones who had already made critical investments in networks, applications, and more, it stood them in good stead when disaster struck. Still, a number of gaps and vulnerabilities were revealed last year. This was particularly in the areas of technology supporting customer experience through mobile apps and improving customer data analytics.

It is apparent that moving to more virtual operations is here to stay. While insurance CFOs are challenged by reduced budgets, technology is a vital investment. It has become evident that spending millions for just-about-average quality is a luxury not acceptable in the post-pandemic world. Stakeholders want to prioritize investment to develop services that can drive revenue.

Changing outlook towards insurtech investments

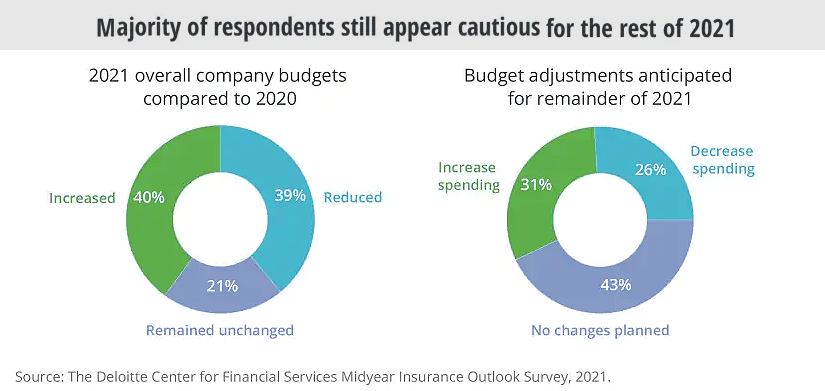

Despite insurtech gaining greater importance than ever before, US insurers are taking a different approach to technology investments. Like almost all companies across the board, insurance carriers have had to deal with budget cuts due to added expenditures. So while the percentage of budgets allocated to technology modernization might have stayed constant or even increased, there is higher scrutiny on how exactly the money is spent. As a result, CIOs have shifted their focus towards finding the insurtech solution that offers them the highest value on their investment.

It’s no longer about who the biggest player is, but how the solution can fuel long-term growth and innovation at the company. This has posed a threat to several insurtech solutions that might be following unsustainable pricing models. At the same time, it presents an opportunity for innovative insurtech companies that provide high-quality solutions at a reasonable cost.

Additionally, the COVID-19 pandemic acted as a catalyst for several planned technology investments. Pipeline process re-engineering plans of investing in a more sophisticated cloud server or ESM platform, for example, have suddenly become even more critical as companies needed to pivot to a safer and more efficient way of working. This is reflected in the way CTO’s are choosing to allocate their technology budgets. One survey, conducted by Deloitte, found that around 59% of approved budgets are being spent on technology that can improve the efficiency of day-to-day operations such as automation and remote working tools. Only 15% of budgets are reportedly being spent on higher-level business initiatives that can drive innovation in the long term.

One survey, conducted by Deloitte, found that around 59% of approved budgets are being spent on technology that can improve the efficiency of day-to-day operations such as automation and remote working tools.

Also read: Why CIOs Say They Will Spend 3.7% of Premium on Tech in 2021

A permanent shift to mobility

Forced to move to a remote work model practically overnight, insurance carriers have had to revamp their IT infrastructure to allow for greater mobility. With the undeniable benefits that most companies have seen from this new model, it’s highly likely that mobility will continue to be a huge focus going forward. The three key areas that will see the greatest push for mobility include:

-

Remote work solutions: Companies that were dependent on on-premise legacy software now have a greater impetus to shift to a primarily cloud-based system. With many employees continuing to work from home, the cloud guarantees higher security and accessibility from any location.

-

Automation and workflows: Higher employee productivity will become critical as many companies have had to undergo budget cuts within talent acquisition. To scale up with a leaner team, carriers will be looking to automate processes that can not only take a significant load off employees’ shoulders but also ensure greater accuracy. App-based support tools and dashboards are slated to become popular over the next few years as they provide the flexibility agents need to perform efficiently in the new work scenario.

-

Virtual customer touchpoints: Carriers need to ensure that customers continue to enjoy a seamless experience despite reduced physical interactions. Customer support, claims processing, payments, and more will be increasingly conducted online.

With the innumerable benefits that insurtech offers leadership, employees, and customers; technology modernization is expected to become even more prominent over the next few years.

Related Blog: Advantage of Implementing Insurance Mobility in Bite-Sized Pieces

Processes gaining from technological investments in 2021

IT investments in process re-engineering are now more than ever, set to have far-reaching effects for the entire organization. When making new technological investments, CIOs will most likely be prioritizing these features:

-

Stakeholder engagement: In a new scenario where insurance agents and customers have limited physical contact, insurance carriers need to find new ways of maintaining stakeholder relationships. Insurtech solutions that offer self-service features, bots, and mobile app usability will be critical.

-

Superior returns on investment: Despite projected growth over the next few years, insurance carriers will have to recover from the immediate economic impact of COVID-19. Due to budget cuts, the focus will now be on new-age insurtech solutions that are more cost-effective to implement and are expected to provide higher returns. Older insurtech players who run on DWP-based renewal models and cost millions to implement are at a clear disadvantage.

-

Pan-organizational usability: New insurtech solutions will likely be used by almost all functions within an insurance company to automate processes. Beyond the IT department, insurance agents, underwriters, surveyors, customer service representatives, and more will have to be onboarded. The new insurtech solution, therefore, will have to offer features that cater to each of these departments.

-

Environmental Social Governance standards: The pandemic has brought social and climate issues to the forefront and this is likely to be reflected in CIO spending. Many US insurers are now re-evaluating their portfolios and underwriting practices in line with ESG standards to address underwriting for fossil fuels, climate risk management, and investments in sustainability.

2021 and beyond

COVID-19 might have acted as a digital adoption accelerator, but what will be the long-term effects on technological investment patterns? According to one survey, 66% of P&C insurers and 57% of L&A insurers expect growth in their industries post-pandemic. As we turn the bend with the pandemic, companies are moving away from the survival phase and adopting a long-term growth mindset. The importance of cloud computing and the application of technologies like ML and AI to automate processes were underscored during the pandemic. As workforces become more nimble and cost-efficiency becomes all the more important, CIOs will be increasingly looking towards innovative insurtech players who can drive bottom-up technology modernization. This will, in effect, insure carriers themselves from future catastrophes and growth fluctuations.

Topics: Insurance Billing Software

.jpg)

.jpg)