How Savvy Insurers Must Woo Millennials and Gen Z with Technology

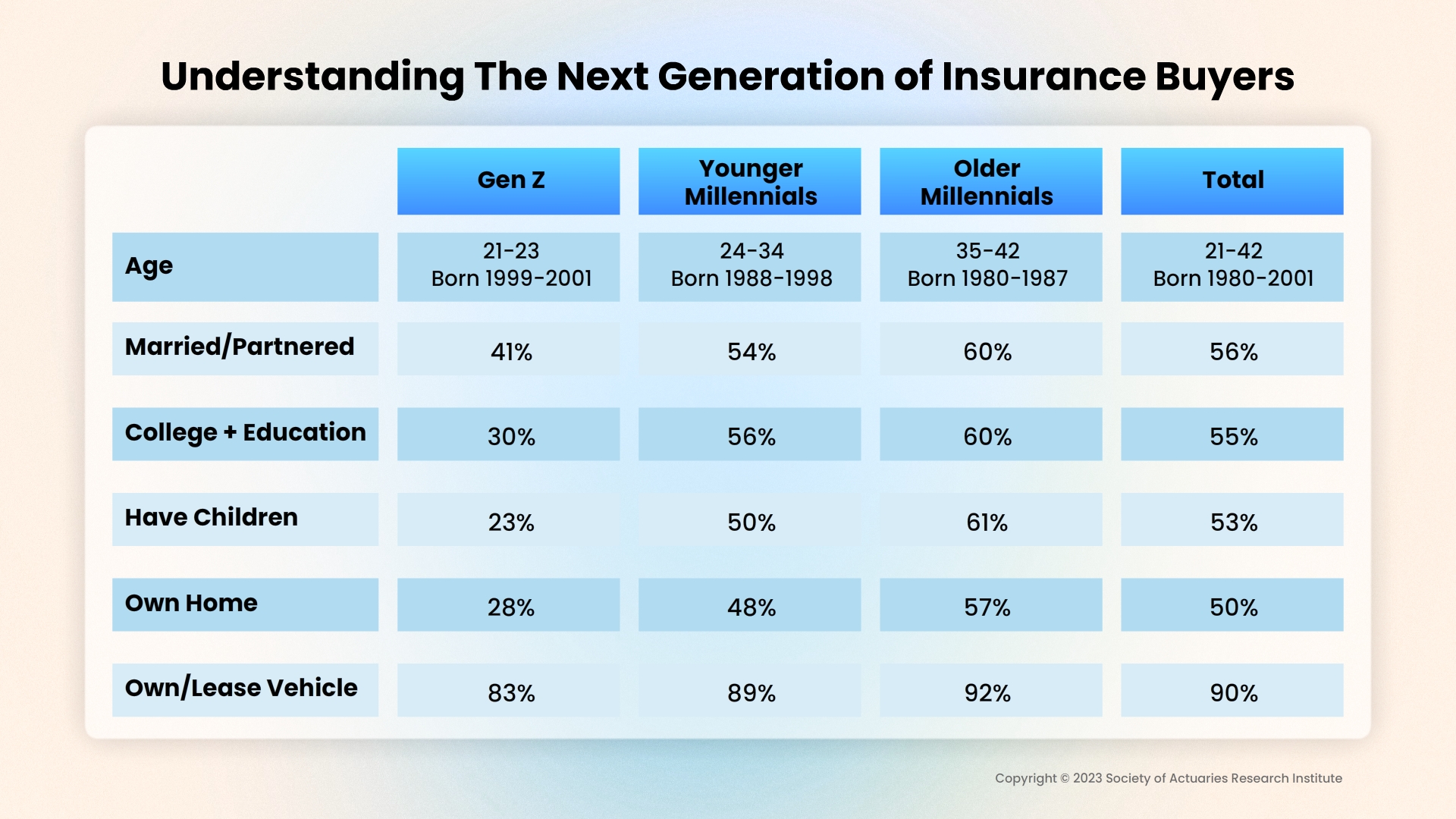

Let's face it: times are changing, and so are the generations dealing with insurance. The oldest millennials are hitting the ripe age of 42 and senior Gen Zers are stepping into their mid-twenties. Despite being often lumped together, these two generations stand on different ends of the insurance experience spectrum. Millennials have been navigating insurance intricacies for a couple of decades, while Gen Z is just starting to dip their toes into the world of policies and premiums – for those who have given them a thought.

Gen Z will become a significant market force in a matter of few years, so insurers will need to shift their focus to understand the unique characteristics and preferences of this generation. Gen Z, having grown up with advanced technology, may have different expectations than their millennial counterparts.

Millennials (steady at 40%) and Gen Z (20%) are expected to constitute a substantial majority of the American workforce by 2025.

Gen Z makes up 20% of the American population, which is 68.6 million. 57% of adults are enrolled in college and 38% have already joined the workforce (Pew Research Center)

Gen Z's insurance perceptions are different from that of millennials

In the insurance world, Gen Z is a potential market that cannot be ignored. While many have insurance, a good chunk of them still ride on someone else's policy – 30% for auto and 24.3% for property. There's an opportunity here for professionals to make a move.

What we know about Gen Z insurance trends is that they are okay with auto coverage, but property coverage seems a bit pricey for their liking. It's a chance for insurance pros to break down the value and practicality of property coverage and reshape their views. A survey by Rocket Mortgage 2 years, back found that 45% plan to own their own home in the next 5 years but a majority of them might prefer to be renters. Will they all opt for home or renter’s insurance? This is a good market for insurers to tap into because Pew Research in 2023 found that 16.2% of Gen Zers who currently rent or own property haven’t yet opted for insurance coverage.

Here's another insight: not many Gen Zers are familiar with umbrella insurance – about a third, to be exact. It's an education gap that experts can fill, explaining why it matters. In the ever-evolving world of insurance, these are the opportunities pros shouldn't miss.

The millennial insurance perception has been shaped by supportive Baby Boomer parents and a more prosperous upbringing. Raised in a time of lower rents and better property opportunities, they developed a sense of independence. Millennials, with their stable upbringing, often followed a traditional path of settling down, purchasing homes, and acquiring insurance as a part of life's milestones.

In contrast, Gen Z was raised in a world where instant access to information is the norm yet increasing inflation has got them living paycheck to paycheck. Many have learned from the high student debts that millennials have been reeling under and have opted for the gig economy. Insurers have to respond to this with customized plans, for instance, Verisk offers coverage options for ride-share and food-delivery drivers. Gen Z insurance trends point to personalized, on-demand services and they are more likely to be attracted to products that can adapt to their changing circumstances.

Gen Z insurance trends point to personalized, on-demand services and they are more likely to be attracted to products that can adapt to their changing circumstances.

From meeting the seasoned expectations of older millennials' insurance needs to addressing the emerging concerns of Gen Z, technology will be the transformative power.

Why Insurance technology must keep up with evolving consumer dynamics

Nearly half of Gen Z (43%) admit that insurance is an unknown ocean to them and they are not ready to slog through 30-40 pages of a policy to understand what they are buying. They want quick, clear answers through apps and intuitive online experiences. They are all about personalized insurance that fits their needs and saves them money. Their loyalty isn't to brands but to ‘value for our cash’.

In a recent survey, a whopping 90% of Gen Z and 75% of Millennials are cool with sharing personal data for a better deal. This includes information from their smartphones, smartwatches, and even social media.

At an average age of 55, C-suite executives represent a generation gap from the oldest Gen Z members who turn 25 in 2023 (Korn Ferry Research). This age contrast creates a significant digital divide because insurers are finding it difficult to leave back the traditional, well-tested processes to meet the new digital expectations. This necessitates a new approach to technology innovation.

1. Meet your customers when and where they are: In the Gen Z vs Millennials insurance debate, everyone agrees that insurers need to adapt quickly to mobile-first technology. Younger customers have expectations of immediacy already ingrained in them. It might be 1 am on a Friday or even over the weekend - a time when most insurers are closed for business but if Gen Z don’t get the answers they need immediately, they might just not have the patience to follow through. This would require a multi-channel marketing approach, utilizing chatbots for quick inquiries, streamlined online application processes, and real-time assistance via various digital channels.

2. The TikTok generation needs to be reached on social media: A Bindable report surveyed Millennials and Gen Z insurance buying habits - 40% consult social media for insurance research. Of those, 69% pay attention to social media influencers, and they're 54% more likely to buy from brands partnered with these influencers. (Insurance Journal).

State Farm's Jake from its TikTok account, has over 2 million followers, and it is a pitch-perfect take on how to reach the new demographic. The humorous and relatable content breaks down traditional stereotypes, renewing interest in insurance among a generation that previously showed little interest.

More than 50% of Gen Zers spend 4 hours or more on social media platforms, every day. This makes social media the first place they look for information.

Insurers will more extensively use AI and telematics to gather data and give personalized recommendations to younger customers. By analyzing information from sources like social media scoring, online behavior, and driving habits, insurers will tailor coverage options and pricing to meet the specific needs and preferences of this generation. For instance, while many Gen Zers might not have moved out from beneath the parental roof because of rising costs, their pet ownership trends exceed that of Gen X or the Baby Boomers.

3. Technology should supplement rather than cut out the human factor: Customer experience (CX) is crucial for retaining customers. Yet, CX has not largely evolved beyond traditional boundaries. Isolated efforts to enhance digital, call center, agent, and direct sales experiences, or standalone initiatives like integrating AI/ML, creating mobile apps, or automating claims, are not enough.

CommBank reports that 49% of Gen Zers feel uneasy about speaking on the phone, with two-thirds of Millennials and Gen Zers preferring to communicate primarily through text.

However, while younger customers might prefer an online experience, they still want to connect with an insurance professional when it comes to big-ticket policies. The agent must be well-supported with the tools to make the conversation effective.

-

Implement Customer 360, offering a comprehensive view of the customer's information throughout their consumer life.

-

Equip yourself with tools that suggest relevant products and solutions, ensuring you can address any question and engage with customers at any step. Tara, the virtual AI assistant from the SimpleINSPIRE insurance platform provides context-based interaction between you and the system as well as connects seamlessly with external insurtech services.

-

Additionally, the insurance platform must be able to instantly track the process within the organization and provide accurate updates to the customer, ensuring transparency and trust in the customer-provider relationship.

While almost every insurer has recognized the writing on the wall, not all have gone the extra mile in integrating an expansive digital experience. Data from Statista indicates that no generational cohort is satisfied with the digital offerings of their insurers. Less than 25% of respondents across generations report that their auto or home insurer delivers a satisfactory range of digital services, including diverse apps or digital claim status notifications.

While larger rivals have started to woo younger customers with multibillion-dollar investments in digital technologies, the smaller players might have to choose wisely where to spend to get the biggest bang for the money spent. Today it is all about interconnected experiences.

Topics: Digital Transformation

.jpg)